The precious metals have shone again in the last seven days. Gold has gained over 5% in that time, while Silver gained 18% from last Wednesday’s low, including yesterday’s 8% surge.

Such a powerful uptrend encourages thoughts of a reversal of the two-year downtrend. We also draw attention to additional factors setting up a positive outlook.

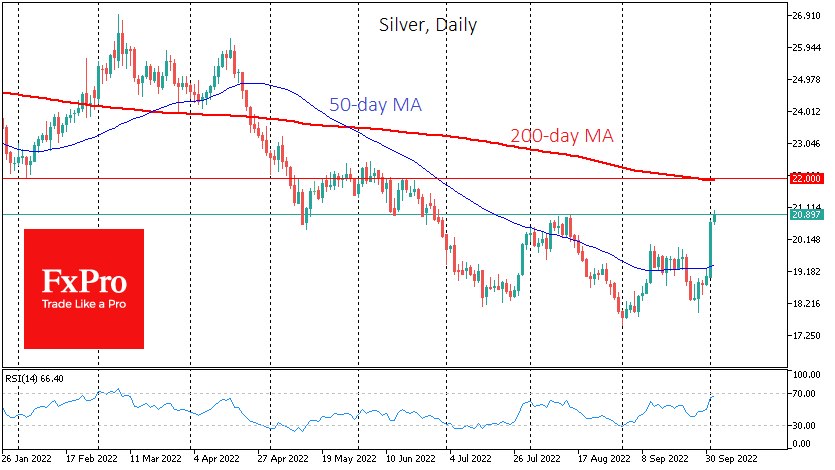

An ounce of Silver is close to $21 – surpassing August peaks and recovering to late June levels. However, we also note that the increase did not come suddenly. In September, there was a shift in balance to buyers when Silver did not mirror the dollar’s strong growth and the stock indices’ fall.

Last week there was a market reversal, which could be attributed to the desire to balance portfolios for the end of the quarter and the financial year in the USA. However, yesterday’s movement in Silver went far beyond balancing. Such strong moves against the trend often act as the start of a new direction.

A bullish divergence in price and RSI was triggered on the weekly charts as the new price low corresponded to higher local lows in the Relative Strength Index.

A sharp spike in the price of Silver brought it back above the 200-week average. A close of the week above $20.8 would confirm the breaking of the downtrend.

However, the upside path should be broken down into multiple phases, at which a brisk ascent may experience significant difficulties. The opposite is also true: the easy climbing to each new level will further encourage buyers.

The next significant hurdle looks to be $22, the lower boundary of the former trading range that operated from September 2020 to May 2022. The 200-day moving average, a meaningful trigger for banks and funds, also lies close to this level.

A consolidation above the $22 level would confirm the idea of breaking the downtrend for broader investors. If successful, the following technical target for the bulls is $28, where Silver reversed from rising to falling in the last two years. Breaking this mark opens a long way to the area of 50, which could take up to two years.

We see Silver as a key to precious metals market sentiment and a precursor to a bullish reversal in gold and overall demand for risky assets.

The FxPro Analyst Team