The precious metals market has slowed markedly after a tumultuous February-March and the second half of May. However, Silver continues to show signs of medium-term upside readiness.

The May sell-off in Silver, which brought the price down over 13% from its peak to bottom at $22.67, was capped by a 3% reversal on May 26.

Later, May closed with a strong upward move touching $24.0 an ounce. And this week, Silver is closing the trading sessions above $23.50 despite the intraday dips. Incidentally, the latter tends to become less and less deep.

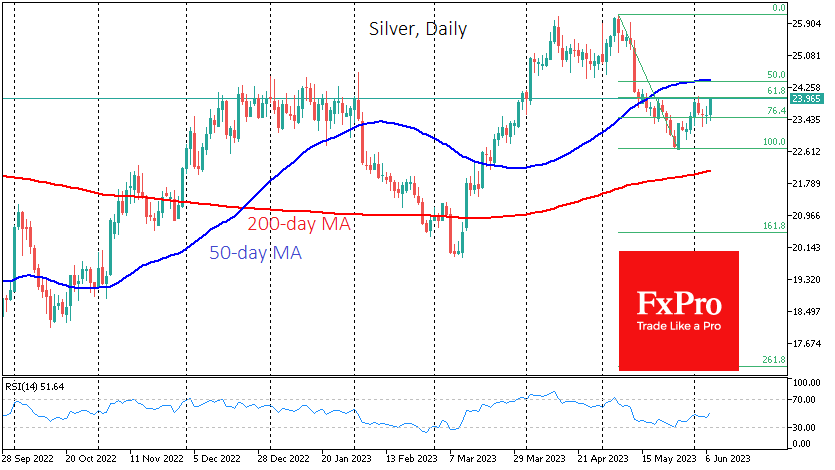

Separately, on the daily timeframes, the RSI index has turned to the upside after touching oversold territory, which is a sign of at least a pause in the downtrend. In addition, the RSI reached higher local lows at the end of May than at the lower point in March, indicating less seller strength.

Although Silver Bulls defend the lower boundary quite effectively, they have yet to prove their ability to push the price higher.

The nearest resistance is in the $24.0 area, where the price reversed to the downside at the start of June. That level also coincides with the 61.8% retracement of last month’s downside move.

A rise above that level qualifies the correction and paves the way to $24.5, a significant resistance area in December-January and the 50-day moving average.

A higher rise would set up a quick return to the $26 area, near the peaks of the last two years. But in this case, the bulls will have already proved their superiority, and reaching $30 will be no more than a matter of time.

The FxPro Analyst Team