While gold prices remain heated and volatile at the top, its precious counterparts—silver and platinum—are attracting bullish interest and surging toward multi-year highs.

Platinum has gained about 35% from its lows at the beginning of the year at $900, reaching $1,225 at the start of the day on Tuesday. The latest rally brought the price back to the 2021 highs, ending a three-year sideways trend. Bulls intensified their push after successfully breaking through the $1,000 level in the middle of last month.

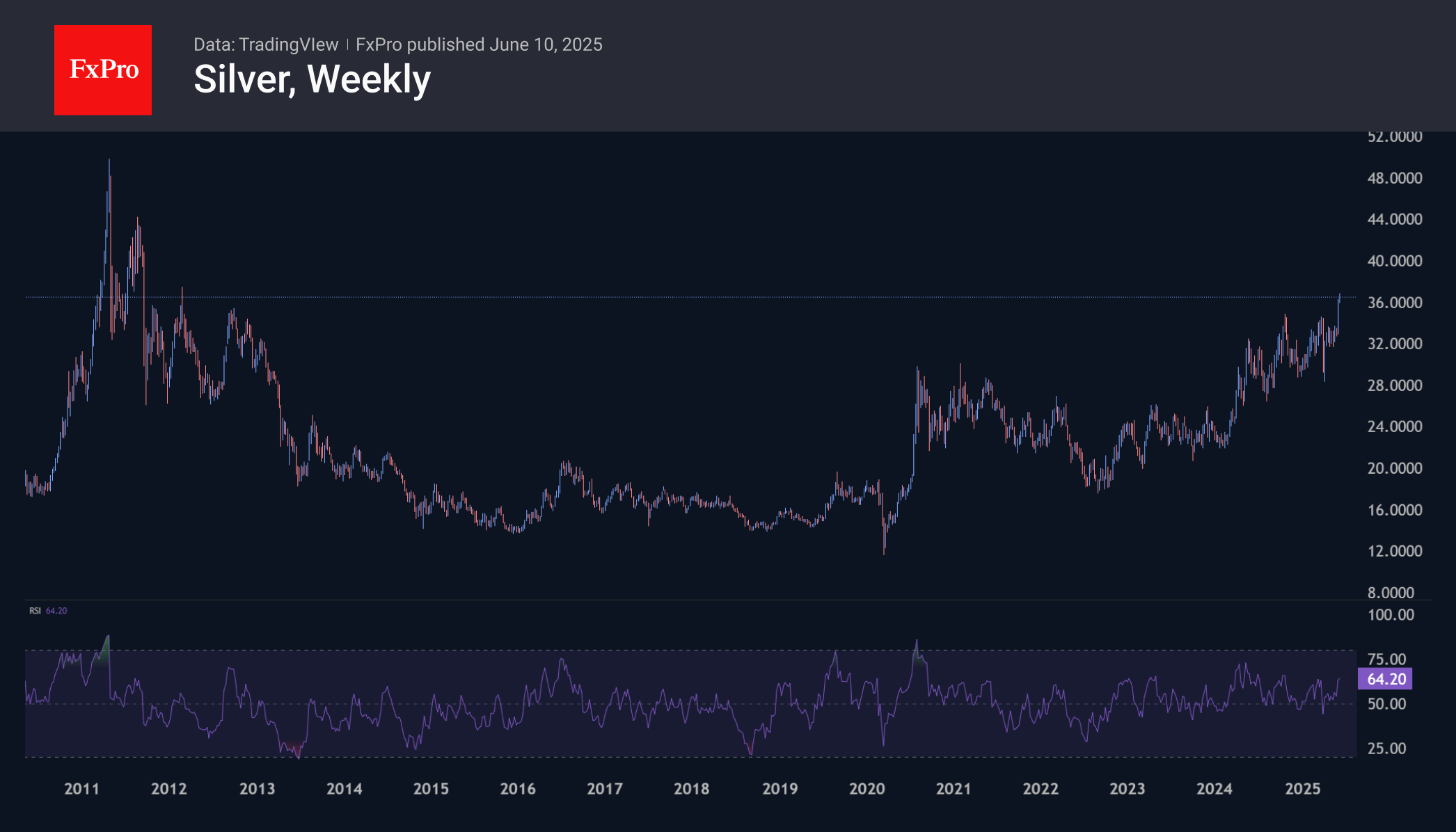

Silver is up 27% since the beginning of the year, accelerating its growth in the last couple of weeks after an 18% correction in early April. With the price reaching $36.9 on Monday, silver is trading at its highest level since February 2012.

In both cases, bulls were encouraged by the rapid correction in gold, which did not turn into a prolonged decline. This was a signal that gold was seeing profit-taking rather than a reversal of sentiment. In such conditions, traders look for alternatives. Since the platinum and silver markets are less liquid, price movements here are usually more significant.

In 2011, the silver rally pushed the price from less than $18 to almost $50. If the momentum that has been driving precious metals since the beginning of the year continues, bulls may aim to repeat the peaks of fifteen years ago or even try to exceed them. On weekly timeframes, silver is not overheated, with an RSI of 64. In 2011 and 2018–2019, only an RSI above 80 was a signal for a reversal.

Platinum has fallen sharply in recent years, falling out of focus for investors as the automotive industry has sought to move away from internal combustion engines, where platinum is actively used. In recent weeks, however, platinum has emerged as an alternative to gold as a metal for gold reserves. However, it has yet to prove its potential. The 2021 turning point is in the $1,200–1,300 range. Successfully overcoming this resistance level opens the way to $1,500 and then $1,900, which, in a bullish scenario, could well be reached by the end of the year.

The FxPro Analyst Team