Gold and silver have been enjoying a return to demand since early May, and buyers have stepped up in the last couple of days, bringing gold back above $2370 and silver back above $28.5.

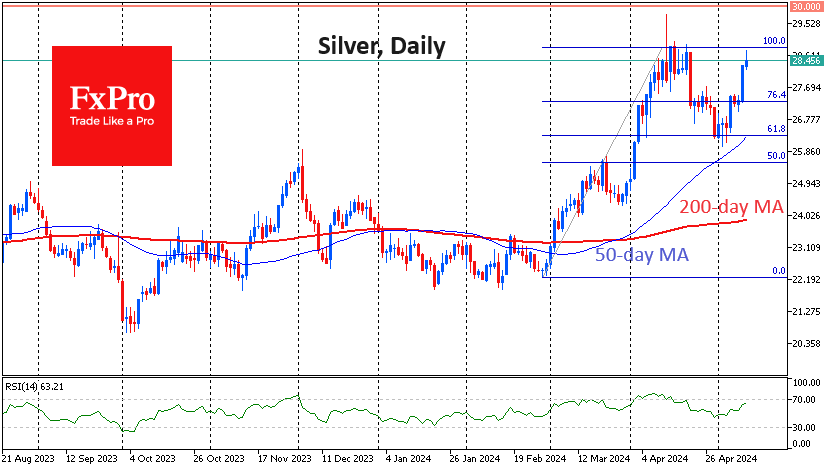

Silver has recovered to the $28.0-28.8 area from where it reversed down in April after a few days of consolidation. This week’s upward momentum revives the idea that the decline in the second half of April was a corrective pullback. The area of local lows in early May roughly coincides with the 61.8% pullback from the upside momentum from late February to the upper boundary of the consolidation area we discussed above.

This bullish scenario will be confirmed if the price consolidates above $28.8, which would open the way to the $33 area as a potential first stop. However, we need to remember that Silver has failed to do so for the past 11 years, with three significant episodes in 2020 and 2021 before the April test.

Gold is about half as far behind silver in terms of relative recovery momentum and has not yet been able to recoup all the losses from the 22 April price hit. However, we should consider that gold quotes have been periodically updating historical highs since February.

In gold, we can also consider the April retreat as a correction to the area of 76.4% of the growth impulse from the minimum close of the day in February to the maximum close in April. In this case, the growth target becomes the area of $2640 (161.8% of the initial rally).

At the same time, a further rise in the price of gold with high bond yields in developed countries, huge budget deficits in many countries and the need to support the economy makes one think that the upside potential is limited. Until gold and silver reach a new level, we doubt the success of a new attack on the highs and see the potential for a renewed decline.

The FxPro Analyst Team