Gold dived below $1800 on Friday morning, testing this year’s low at $1790. It has managed to get support from buyers on a dip below the important round level in the last six months, but this time buyers may come to the rescue much later.

The latest financial market dynamics (falling equity prices and yields) suggest the markets are banking on a recession. Meanwhile, central banks are only picking up speed in tightening monetary policy, creating pressure on long-term inflation expectations. In such an environment, demand for gold as insurance against inflation promises to decline in the coming weeks. A reversal in gold may not occur until G7 central banks begin to soften their rhetoric, which could take months.

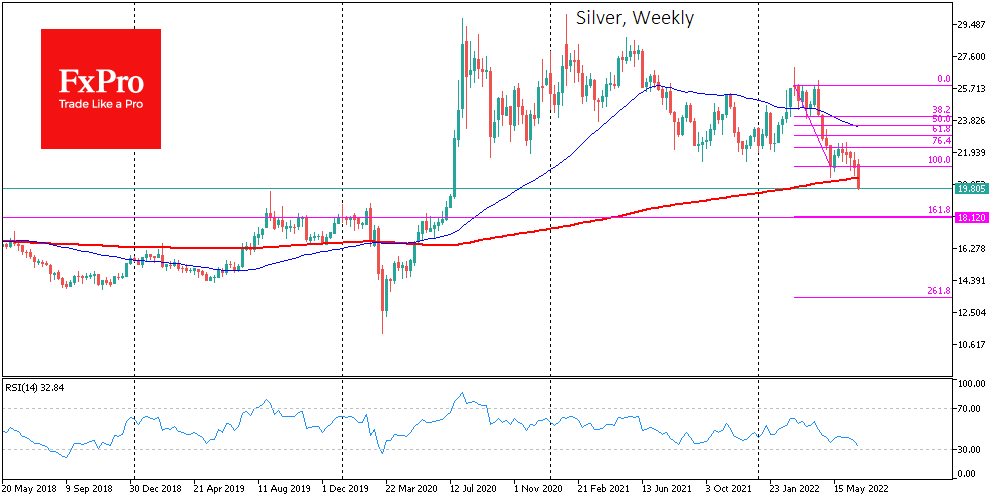

The performance of silver is even more pessimistic. Gold’s little sister is far more sensitive to production cycles. Since the beginning of last month, signs of an economic slowdown have formed a downward momentum in silver, forming a bearish technical picture.

The drop of silver below $21 earlier this week marked a consolidation below the local lows of early May after a corrective bounce. The next stopping point for silver might be the $18.10 (8.5% below today’s price), where the 161.8% level of the March-May decline lies. In addition, here is the former resistance area from 2017 to 2020. It now has the potential to become an equally important long-term support.

For gold, the significant downside milestone is now the $1700-1730 area, where last year’s lows and the 61.8% retracement level from the 2018 to 2020 rally are concentrated. If that level also falls in the coming weeks, the following line of gold defence gold could be the $1650 level, where the 200-week average and the 50% retracement level from the two-year rally pass through.

The FxPro Analyst Team