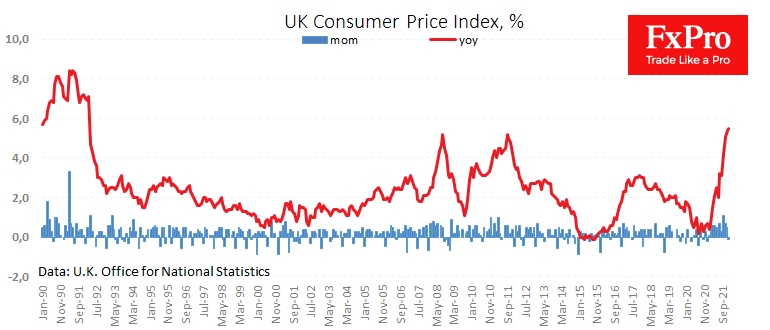

Britain’s consumer price index fell 0.1% in January, not as sharply as analysts had expected; they were expecting an average fall of 0.2%. Year over year inflation reached 5.5%, a new record since March 1992. There are plenty of signs that peak inflation is near, but the big question is how quickly price growth will return to its 2% target and what effort it will take from the Bank of England.

Among signs of a cooling inflation outlook, we highlight the second month of slowing producer prices to 13.6% YoY in January against 13.9% and 15.2% in the previous two months. This is an early indicator which allows us to expect less pressure from commodity prices on producers further down the line, which will cool consumer inflation in the coming months.

Among the early indicators of inflation around the world is also the Chinese producer price index, which noted a slowdown in January to 9.1% from 10.3% a month earlier and a peak of 13.5% in October.

The publication of the UK inflation accelerated the rise in the pound, sending GBPUSD above 1.3570.

The FxPro Analyst Team