The US labour market is stagnating despite an apparent increase in the number of jobs. Data published on Friday for January showed an increase in the number of jobs by 151 thousand, close to the forecasted 159 thousand and better than January’s 125 thousand. The indicator matched expectations without causing price slippage on Forex, which is both feared and expected by many traders. The first reaction of the US stock indices was also very subdued, but this is a case where it is worth digging into the data to avoid being on the wrong side of a trade.

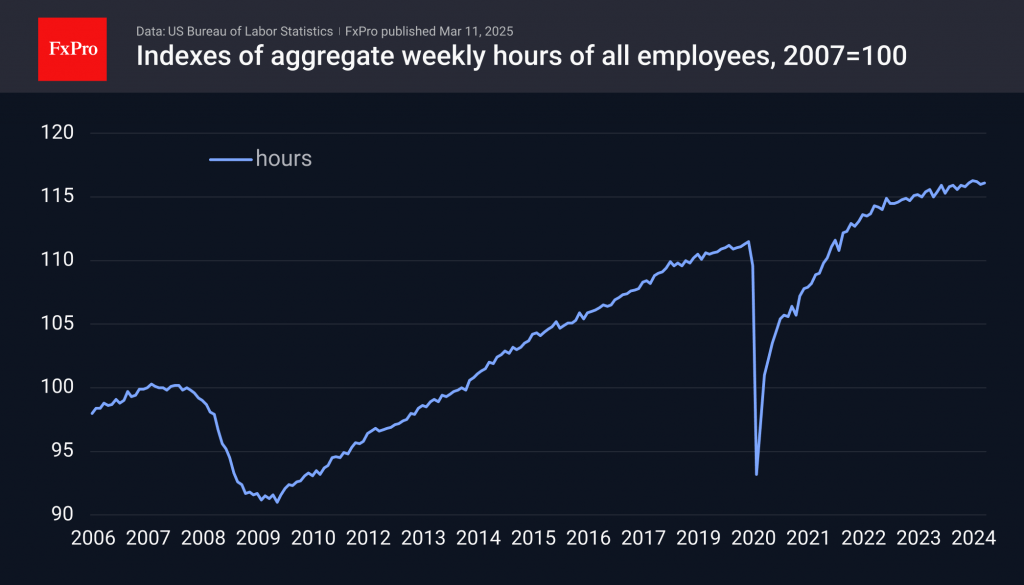

A rise in the number of people employed was offset by a decline in hours worked per week to 34.1, having been on track for a decline last March at 34.4. As a result, the index of total hours worked in the economy is 116.1, the same as in October and below the November peak of 116.3.

A parallel survey, based on household surveys, noted an increase in the unemployment rate to 4.1%. The labour force participation rate fell to 62.4%, a 25-month low: people are giving up trying to find work. Without this balancing act, unemployment would have jumped to 4.4%.

Data published on Tuesday also shows how small business optimism, the driving force behind the economy, is melting away. The NFIB indicator fell to 100.7, declining for a second month after peaking in December, losing its initial surge after Trump’s victory. The sub-indexes ‘uncertainty’ component has been at its highest level since pre-election in October 2024 and is well above pandemic levels.

Equity markets typically lose during periods of uncertainty, so the dynamics of the last two to three weeks are understandable. But quite unexpected and discouraging are the dollar’s losses over the past two months. One of two things: either markets are not really afraid but regroup, or we are seeing a tectonic shift where treasuries are not perceived as a protective asset.

The FxPro Analyst Team