Exxon Mobil’s been in the Dow in some form since 1928, but its tenure as the longest-serving component is coming to an end. On Monday, S&P Dow Jones Indices announced the largest changes to the 30-stock benchmark in seven years. Along with Exxon, which is being replaced by Salesforce, Pfizer and Raytheon Technologies are being removed in favor of Amgen and Honeywell International. The changes take effect Aug. 31.

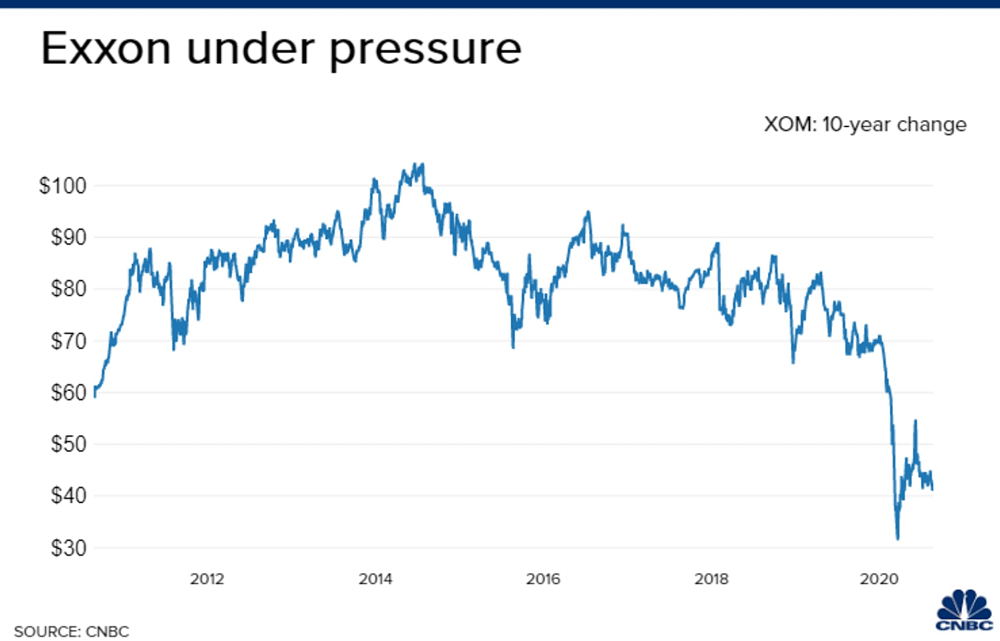

Exxon’s removal is a “sign of the times,” Raymond James said, as the company — and energy sector broadly — falters, a weakness made all the more apparent by strength in technology names. Energy now makes up just 2.5% of the S&P 500, compared with 6.84% five years ago, and 10.89% 10 years ago. Technology has jumped from 18.48% of the index in 2010 to 28.17% today.

Chevron is also in the Dow, meaning the energy sector was overrepresented in the benchmark to begin with. And with Apple’s coming 4-for-1 stock split, the Dow’s exposure to tech was set to decrease. Exxon shares fell 3% on Tuesday after news of the removal.

Over time the S&P 500 has surpassed the Dow in importance given that it better reflects the market and economy. Not only does it contain hundreds of additional stocks, it’s also market-cap weighted, which means that larger companies have a greater influence. The Dow, on the other hand, is price weighted.

Why Exxon and not Chevron?

Chevron shares, while also struggling this year, have returned roughly 25% over the last five years. Its stock price is currently a little more than double Exxon’s. While this is not relevant to investing generally, it is relevant to the price-weighted Dow. But that’s likely not the only reason Exxon got the ax instead of Chevron.

Exxon Mobil replaced by a software stock after 92 years in the Dow is a ‘sign of the times’, CNBC, Aug 26