After a very mixed start to June, platinum, silver and gold are moving into a friendly downtrend. However, a technical correction is unlikely to break the long-term bullish trend.

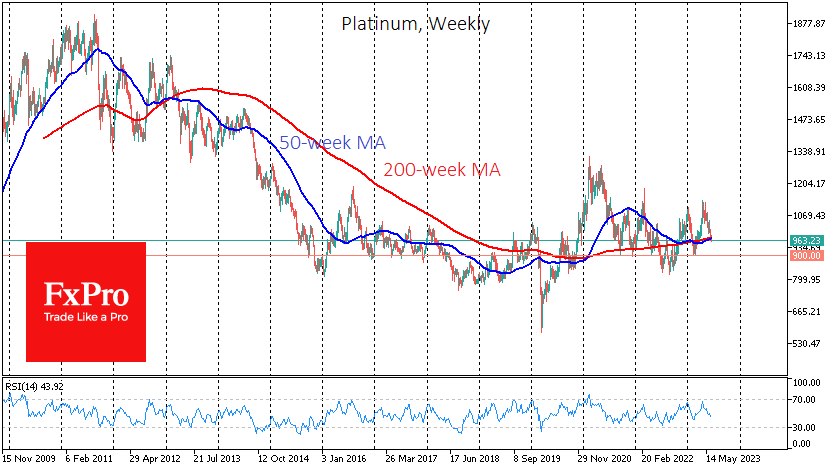

Platinum has lost over 3% since the beginning of the month, adding to the previous 10% drop from May’s highs, to end the month near $960, the lows of the second half of March.

The current sell-off looks like a liquidation of positions for funds focused on the longer-term technical picture. We see increased selling pressure for the third session back-to-back following a break below the 200 and 50-week moving averages (MA). However, platinum has not entered oversold territory, leaving the potential for a decline towards $900, where it has repeatedly found support since late 2015.

Silver is testing support at $23.2 for the third time since early June, following a sharp 3% fall on Tuesday. However, the metal has rallied more than 7.5% in the two weeks since the end of May. The price has reversed and failed to break above the 50-day MA and the 50% level from May. Silver would need to fall another $1 to $22.15 to reach strong support at the 50 and 200-week MA.

Gold’s bounce back to $1931/oz took it back to the June lows and has not been consistently lower since March. The multi-year bullish trend in 2018 was interrupted by a brief dip below the 200-week MA in August-November last year, the period of global central banks’ most aggressive rate hikes. This line is now targeting $1860 by the end of the year.

The FxPro Analyst Team