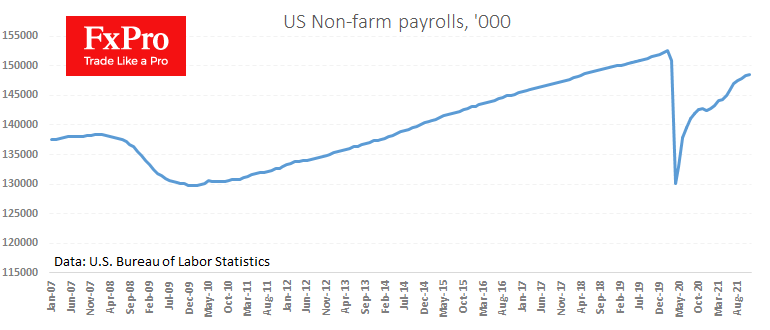

In November, The US economy created 210K jobs, a shockingly low number compared with the expected 550K. And this is the weakest increase since January. This indicator noted a close correlation with the dynamics of new coronavirus cases, which are also at their highest since the beginning of the year in the USA.

Average hourly earnings rose by 0.3%, maintaining the annual rate of 4.8% and falling short of expectations of a rise to 5.0%. It will not be surprising if policymakers comment in the coming days to raise the question of whether the recovery is losing steam. This is a negative surprise for the dollar as it reduces the pressure on the Fed with accelerated unwinding and faster rate hikes.

The unemployment rate and the share of the economically active population, measured differently, contrasting sharply with the data above, marking a significant improvement. The unemployment rate has collapsed from 4.6% to 4.2%. This is a return to the multi-year norm, indicating a full labour market recovery. Notably, however, the economically active population has risen to 61.8%, indicating that the fall in unemployment is not the result of a shrinking labour force.

Traditionally, markets pay more attention to month-on-month changes in employment numbers, but in this case, the effect of this extremely weak NFP data is balanced by a healthy, low unemployment rate.

The FxPro Analyst Team