Preliminary US PMI estimates pointed to further deterioration in manufacturing activity, but the services sector remained a solid driver of the economy.

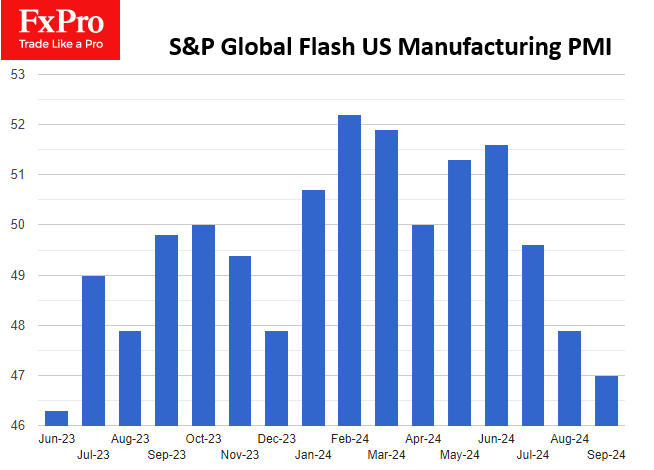

The manufacturing PMI fell to 47.0 in September from 47.9 in August and was expected to rise to 48.6. A reading below 50 indicates that activity has been contracting since July. This data contrasts with the surge in manufacturing activity in August, which the Fed reported last week.

The opposite picture is seen in the services sector, where the latest reading of 55.4 indicates a continuation of roughly the same expansion rate since May, after a very subdued period from August to April this year.

The services reading pulled the composite index above expectations, which seems like good news so far. The US service sector accounts for up to 80% of GDP, and it was already feeling confident many months before the rate cuts. The Fed’s dovish stance could lead to further acceleration.

Such news will be negative for equities and positive for the dollar only if Fed officials see it as an excuse to slow the pace of rate cuts. So far, however, the FOMC prefers to celebrate the victory over inflation.

The FxPro Analyst Team