The Senate passed legislation on Wednesday that could ban many Chinese companies from listing shares on U.S. exchanges or raising money from American investors without adhering to Washington’s regulatory and audit standards.

The bill, sponsored by Louisiana Republican Sen. John Kennedy, would require companies to certify that “they are not owned or controlled by a foreign government.” Alibaba, an e-commerce giant based in China, saw its U.S.-listed shares fall more than 2% on the news.

Though the law could be applied to any foreign company that seeks access to U.S. capital, lawmakers say the move to strengthen disclosure requirements is aimed principally at Beijing.

“The Chinese Communist Party cheats, and the Holding Foreign Companies Accountable Act would stop them from cheating on U.S. stock exchanges,” Kennedy, a member of the Senate Banking Committee, wrote Tuesday afternoon on Twitter. “We can’t let foreign threats to Americans’ retirement funds take root in our exchanges.”

Specifically, the statute would require a foreign company to certify it’s not owned or manipulated by a foreign government if the Public Company Accounting Oversight Board is unable to audit specified reports because the company uses a foreign accounting firm not subject to inspection by the board. If the board is unable to inspect the company’s accounting firm for three consecutive years, the issuer’s securities are banned from trade on a national exchange.

The Public Company Accounting Oversight Board, overseen by the Securities and Exchange Commission, is the nonprofit body that oversees audits of all U.S. companies that wish to raise money in the public markets.

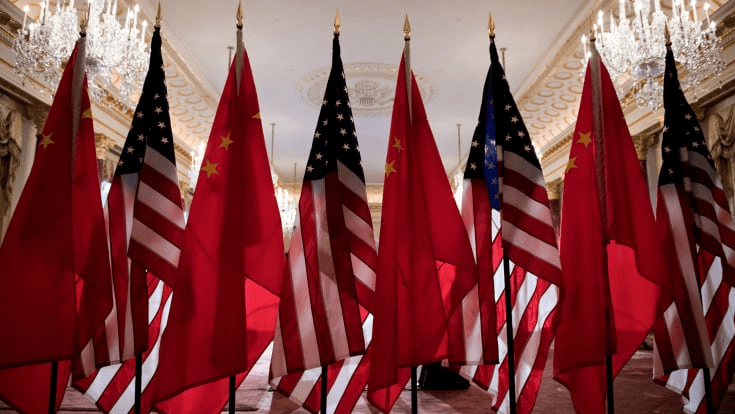

The bill’s passage via unanimous consent around noon reflects the growing anger among U.S. lawmakers toward China, its handling of the Covid-19 outbreak and what many American regulators say is a persistent disregard of American financial disclosure standards.

Senate passes bill on oversight of Chinese companies, Alibaba shares move lower, CNBC, May 21