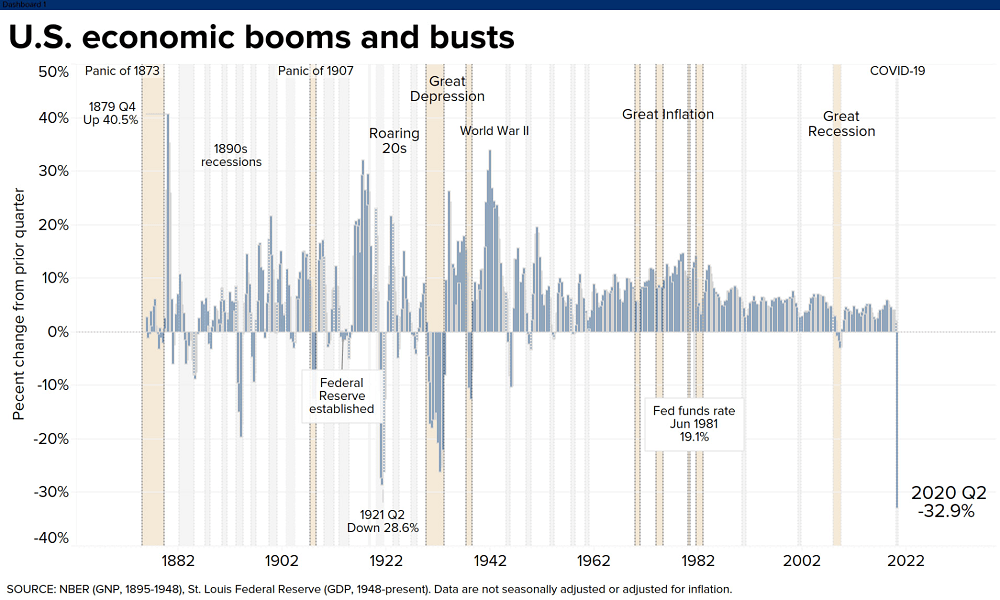

The U.S. economy saw the biggest quarterly plunge in activity ever, though the plummet in the second quarter wasn’t as bad as feared. Gross domestic product from April to June plunged 32.9% on an annualized basis, according to the Commerce Department’s first reading on the data released Thursday. Economists surveyed by Dow Jones had been looking for a drop of 34.7%.

Still, it was the worst drop ever, with the closest previously coming in mid-1921. The report “just highlights how deep and dark the hole is that the economy cratered into in Q2,” said Mark Zandi, chief economist at Moody’s Analytics. “It’s a very deep and dark hole and we’re coming out of it, but it’ going to take a long time to get out.”

The report comes amid a recession that began in February and pulled first-quarter growth down 5%. On a quarterly basis, the Q2 decline was 1.8%.Sharp contractions in personal consumption, exports, inventories, investment and spending by state and local governments converged to bring down GDP, which is the combined tally of all goods and services produced during the period.

Personal consumption, which historically has accounted for about two-thirds of all activity in the U.S., subtracted 25% from the Q2 total, with services accounting for nearly all that drop.

Spending slid in health care and goods such as clothing and footwear. Inventory investment drops were led by motor vehicle dealers, while equipment spending and new family housing took hits when it came to investment.

However, personal income soared, thanks in large part to government transfer payments associated with the coronavorus pandemic. Current-dollar personal income rose more than six-fold to $1.39 trillion, while disposable personal income shot up 42.1% to $1.53 trillion.

Workers across the country were told to stay home from any job not considered essential, resulting in a crushing halt that saw the unemployment rate peak at 14.7%, a post-Depression high. The National Bureau of Economic Research said the current recession actually started in February, a month before the pandemic declaration. First-quarter GDP fell 5%.

Also Thursday, the government reported that the number of Americans who filed new claims for unemployment benefits last week totaled 1.434 million. Although it was roughly in line with expectations, it was the 19th straight week in which initial claims totaled at least 1 million and the second consecutive week in which initial claims rose after declining for 15 straight weeks.

Second-quarter GDP plunged by worst-ever 32.9% amid virus-induced shutdown, CNBC, Jul 30