Oil and gas remain hot topics in the markets. Although these energy prices have corrected from their recent highs, the uptrend promised to be with us if there are no signs of de-escalation in Ukraine. Moreover, high energy prices are turning into a new reality that could stay with us for years to come.

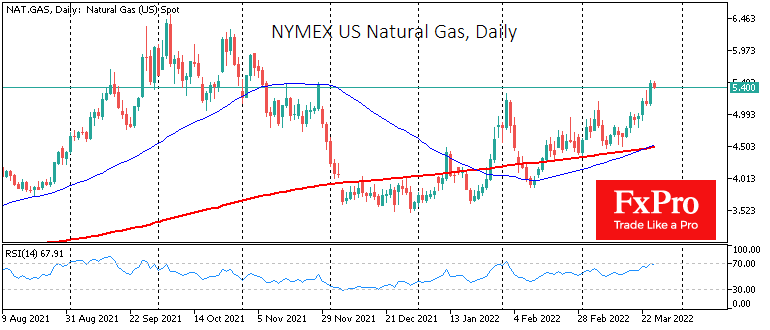

While most news headlines focus on spot gas price developments in Europe, an upward trend has also emerged in the US. This trend has intensified over the past ten days amid discussions about cutting gas supplies from Russia.

Biden urged Europe to increase its US liquefied natural gas purchases, even though supplies were already double the previous year’s level. Putin’s demand to be paid for Russian gas in roubles makes these purchases as uncomfortable as possible. Such a move would accelerate Europe’s rejection of Russian energy, proving to voters in the region that they cannot rely on Russian power.

The demand for alternative gas from the US and the Middle East is growing. And this demand promises to be a long-term trend. Even in the event of a military de-escalation in the coming weeks, attitudes towards Russia in Europe and the US will be tainted for years, and European countries will continue their economically unprofitable reliance on gas from Russia.

The US has all but tapped its spare capacity to produce and supply gas to Europe. It will take time to expand, so competition among buyers is now gaining momentum.

Much of the same applies to Russian oil, which is exported at 4 million BPD and, with political will, could be fully substituted in less than a year. OPEC is not showing the necessary will and is in no hurry to take Russia’s share of the global oil trade.

While oil and gas consumers in Europe and some Asian countries are cutting back as much as possible on purchases from Russia, energy prices on global markets continue to rise. At the same time, the discount for spot prices for Russian oil and gas remains exceptionally high.

Reducing Russia’s 30% share of Europe’s gas supply is painful and long-term. Finding a new balance could take several quarters or even years, during which energy prices will remain above long-term average levels or occasionally spike.

The FxPro Analyst Team