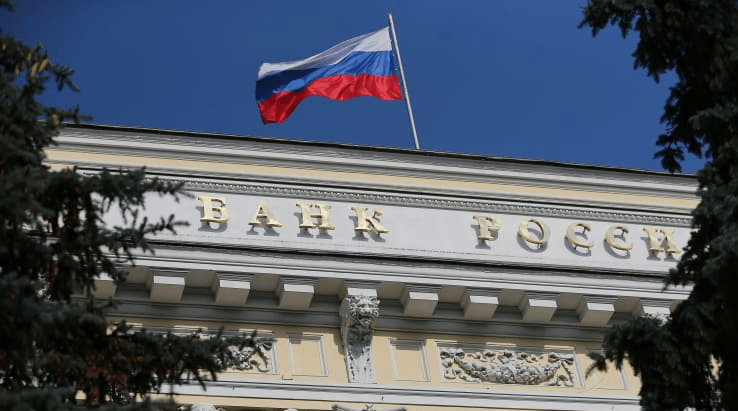

The Central Bank of Russia (CBR) is expected to cut its benchmark interest rate on Friday to its lowest level since the fall of the Soviet Union. Bank Governor Elvira Nabiullina said last week that lower inflation across the first five months of the year has freed up space for the central bank to make further cuts, as it looks to shore up the economy in the aftermath of the coronavirus pandemic.

Economists are torn on the size of the reduction, with some expecting 50 basis points, bringing the rate to 5% following a 50 basis point cut in April. This equals a post-Soviet Union low reached in June 2010. Others anticipate a much more heavy-handed 100 basis point cut this time around. After economic conditions seemingly bottomed out in April and began to rebound in May and June, stronger domestic inflationary pressures may return, according to Matthias Karabaczek, European analyst at the Economist Intelligence Unit.

Although a rate cut is almost unanimously expected, there is some skepticism over the impact lower financing costs can have on the Russian economy, which remains hostage to a lack of demand for credit and investment from businesses due to a variety of structural issues. Vladimir Tikhomirov, chief economist at BCS Financial Group, told CNBC that a lack of demand for new loans for investment meant the Russian economy was slowing even before the coronavirus pandemic, particularly in the export-driven sectors which constitute a significant portion of the Russian gross domestic product.

Major economies such as Japan and the euro zone have long endured economic stagnation despite interest rates at or below zero in a bid to encourage borrowing. Tikhomirov suggested that increasing government spending on pensions, salaries or subsidies, or investment in infrastructure projects to drive demand, would be a more effective means of rejuvenating the economy in the aftermath of the crisis.

Russia could cut interest rates to a historic low, but economists see little impact, CNBC, Jun 17