Among the major US market indices, the Russell 2000 is perhaps the most sensitive to changes in monetary policy and consumer demand in the country.

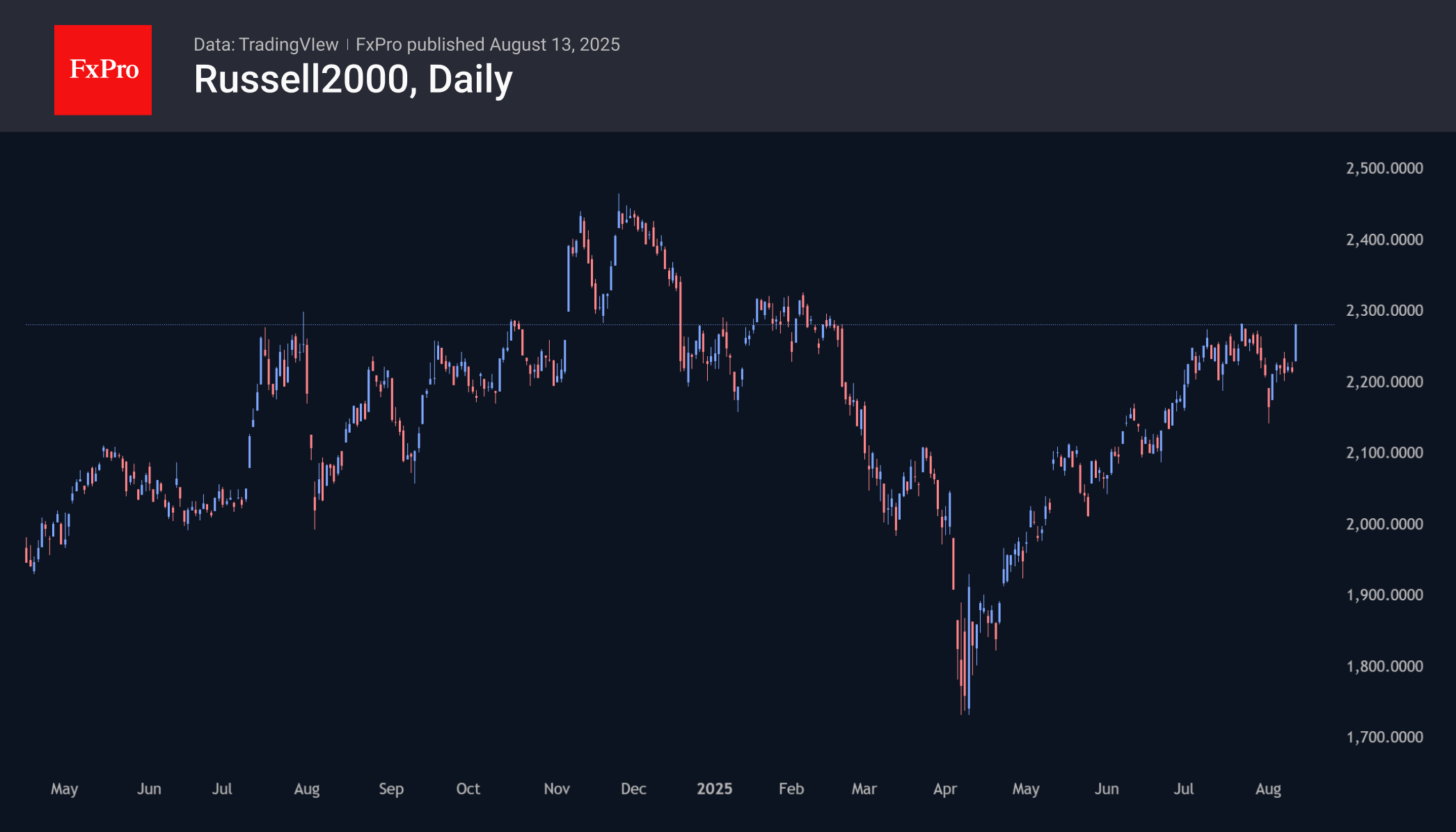

Therefore, it is not surprising that the US small-cap index exceeded 2300 on Wednesday, adding almost 8% to the lows set on 1 August, compared to 4% for the S&P 500 and 5.5% for the Nasdaq100. The dividing line was a weak labour market report, which brought the question of a Fed rate cut in September back to the table. The inflation report released on Tuesday cemented these expectations, triggering a 4% rally in the Russell 2000 since then.

This acceleration is explained by increased corporate lending. Small companies rely heavily on these loans, while large corporations prefer spending their cash on share buybacks instead of borrowing.

When strong corporate reports drove the market, the Nasdaq 100 was the leader in relative dynamics. The headwinds in the form of trade tariffs, which turned out to be lower than initially feared, also decreased significantly, and delays remain in place for China.

As a result, the Russell 2000 rose to its January-February highs, only now emerging from the ‘tariff pit.’ However, it still has a long way to go before climbing back to its historical highs—the index needs to recover from its current level of 2450 and the double peak reached in late November 2024 and November 2021.

The FxPro Analyst Team