Former US Congressman Dr. Ron Paul recently attended the crypto Consensus conference in New York as a guest of the Digital Asset Policy Network. During his visit the retired politician and godfather of the modern right-wing Libertarian movement spoke about the death of the dollar and Bitcoin’s growth as a disruptive and sovereign asset.

Speaking in an interview with Bitcoin Magazine Dr. Paul stated that he wasn’t technically minded but has been fascinated by Bitcoin, its market action and wild price swings. He added that Bitcoin offers an alternative to the current financial system and that he strongly advocates a free market place.

Earlier this month Congressman Brad Sherman called for an outright ban on Bitcoin stating at the time; I look for colleagues to join with me in introducing a bill to outlaw cryptocurrency purchases by Americans so that we nip this in the bud, in part because an awful lot of our international power comes from the fact that the dollar is the standard unit of international finance and transactions …

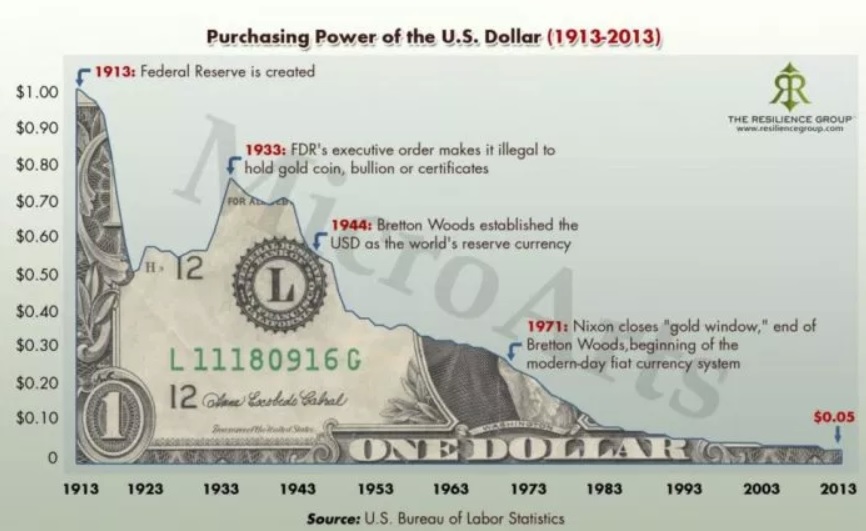

Ron Paul, when questioned on this, simply replied that Sherman doesn’t have the clout since he’s over the top and that a Bitcoin ban is highly unlikely. He added that Congress in general had less interest in Bitcoin and that they haven’t really thought it through. When asked about the validity of Sherman’s crypto threat to the dollar argument Dr. Paul replied; That tells you a lot. He’s speaking for the deep state establishment, military people and everyone else in the banking system. He’s representing their position that “You don’t mess with the dollar.” But I don’t worry about that because the dollar is going to self-destruct.

In his 2009 book ‘End the FED,’ Ron Paul referred to the dollar as a ticking time bomb so was asked if crypto could be seen as a hedge in times of market volatility. He replied that citizens should be allowed to have a hedge, for years Americans were not allowed to own gold under something called the Gold Reserve Act. With an ever more tumultuous foreign policy another massive financial crisis such as the 2008 crash could be around the corner.