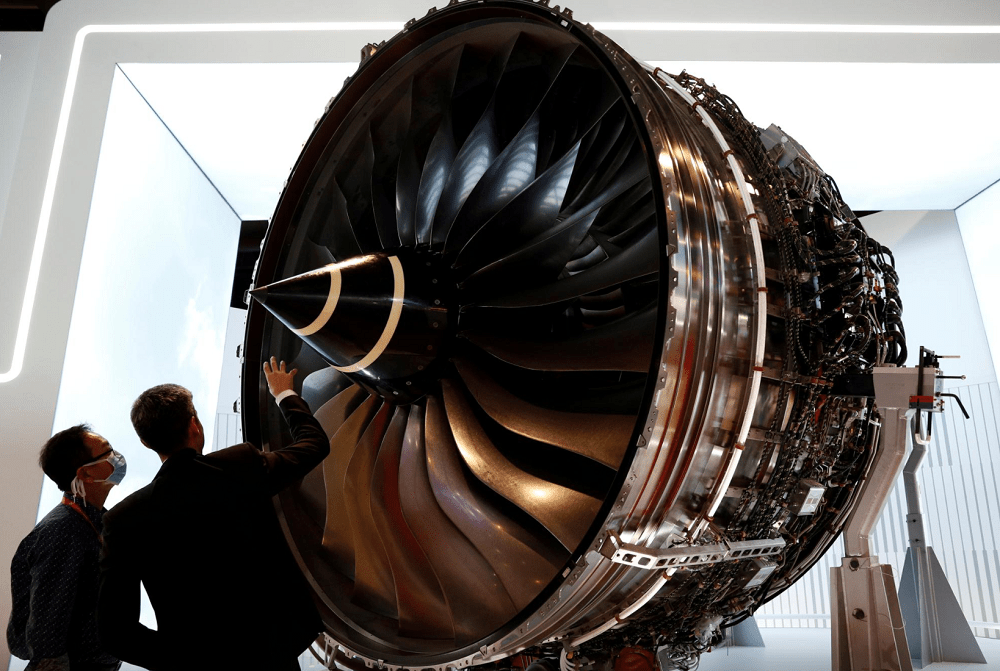

British engine-maker Rolls-Royce plunged to a worse than expected 4 billion pound ($5.6 billion) loss in 2020 as the pandemic stopped airlines flying, but stuck to its forecast to burn through less cash this year. Rolls’ model of charging airlines for the number of hours its engines fly meant much of its income dried up last year when travel stopped. In 2020, it secured a total of 7.3 billion pounds in debt and equity to help it survive.

Last year’s cash burn of 4.2 billion pounds was in line with analysts’ expectations, and Rolls guided that would reduce this year to 2 billion pounds, turning positive in the second half when travel is expected to pick up. Rolls’ civil aerospace arm accounts for just over half of group revenue in a normal year. On an underlying pretax basis, Rolls posted a loss of 4 billion pounds, worse than the 3.1 billion pound loss forecast by analysts.

Despite that, the company said on Thursday its liquidity position was strong and it could cope with even in a severe downside scenario. Its shares opened up 2.6% at 116 pence. After taking on 5.3 billion pounds of debt last year, Rolls is planning to repair its balance sheet by selling assets worth 2 billion pounds, the major part of which will be Spain-based ITP, which is currently on the block.

Rolls-Royce plunges to worse-than-expected $5.6 billion loss, Reuters, mar 11