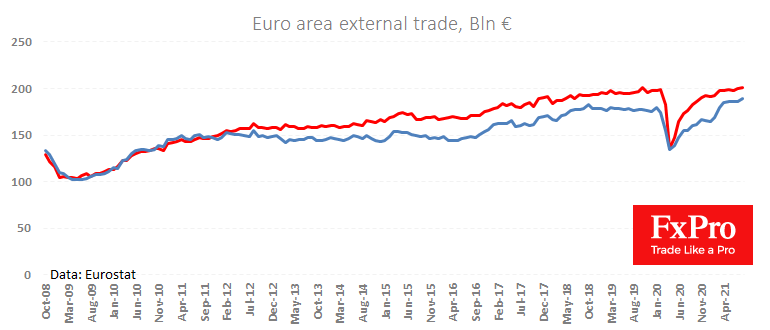

The eurozone’s trade surplus is under pressure this year, reducing support for the single currency against rivals. Data published today showed a reduction in the seasonally adjusted trade surplus to 11.1bn, compared with the expected 14.1bn and 13.5bn a month earlier.

Except for April and May 2020, these are the lowest levels since October 2018, when oil and gas prices also rallied violently. Admittedly, energy prices have risen more dramatically between August and now, promising an even more significant jump in the cost of imports.

It is also noteworthy that exports seem to be hitting a glass ceiling close to EUR 200 billion, chipping away at it from 2019. The weakening trade surplus underlines the difficulties for the region’s economy amid rising commodity prices. This is a new batch of bad news for the Euro, whose dynamics this year are closely mirroring those of the trade surplus.

The FxPro Analyst Team