Gold has added for the fifth consecutive trading session – the longest streak since early April. Intraday yesterday gold reached $1865, having retreated to $1860 now.

Although Gold’s prolonged rise in early April turned into a sell-off of almost three times the amplitude and duration, there are signs that we see the beginnings of a more sustainable move this time around.

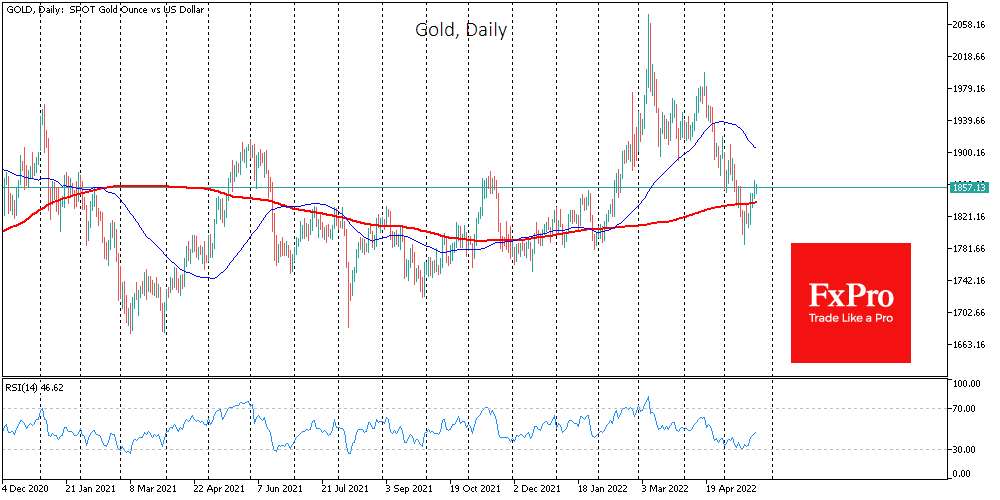

In early May, the daily gold charts developed an oversold RSI. The recovery from oversold conditions supports the local demand for Gold.

A return above the 200-day moving average by Gold is also playing on the bulls’ side locally. A dip below could well be seen as a false breakout. A recovery above the significant trendline, the 200-day average, acts as additional psychological support.

A third important reason to buy Gold is the strengthening of the Euro. Since early April, a strong positive correlation between Gold and the EURUSD exchange rate has been well established. This correlation was broken earlier in the year by the events in Ukraine and before that by the substantial divergence in the monetary policy of the Fed and the ECB.

Nevertheless, it is easy to see that the Euro and Gold are moving together over the longer term in quiet times. Perhaps we are now seeing the beginning of a medium-term correction of the Euro thanks to increasingly hawkish signals from the ECB.

The nearest important test of the bulls’ intentions could be the $1875 area – the November highs. If it succeeds, investors and traders should keep an eye on the dynamic at $1910, where the bulls’ attack stopped at the beginning of May this year and at the end of May 2021.

The FxPro Analyst Team