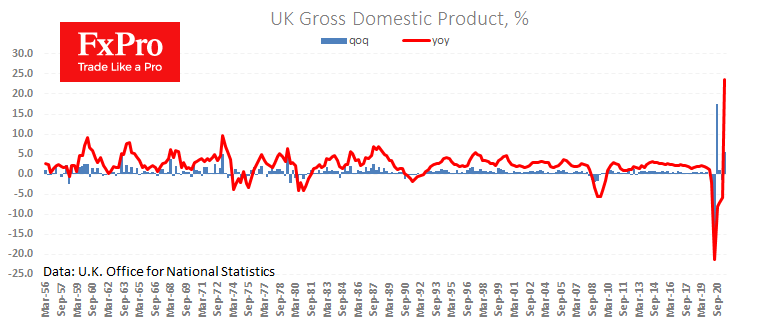

The final UK GDP data for the second quarter came as a positive surprise. The growth estimate was raised from 4.8% QoQ and 22.2% YoY to 5.5% QoQ and 23.6%.

The reduction of the balance of payments deficit to 8.6bn, the lowest level since 2011, contributed significantly. Also worth noting is the jump in business investment by 4.5% QoQ and 12.9% YoY.

These are favourable figures which in normal times would have signalled a confident situation in the economy and would have supported the strengthening of the Pound and the rise in the FTSE100.

But these statistics are now being taken as a look in the rear-view mirror, with a surge in imports due to rising energy prices and its potential impact on the economy in the coming months on the agenda. Strong figures, in this case, will only strengthen the base effect before weakening in the closing third quarter.

The FxPro Analyst Team