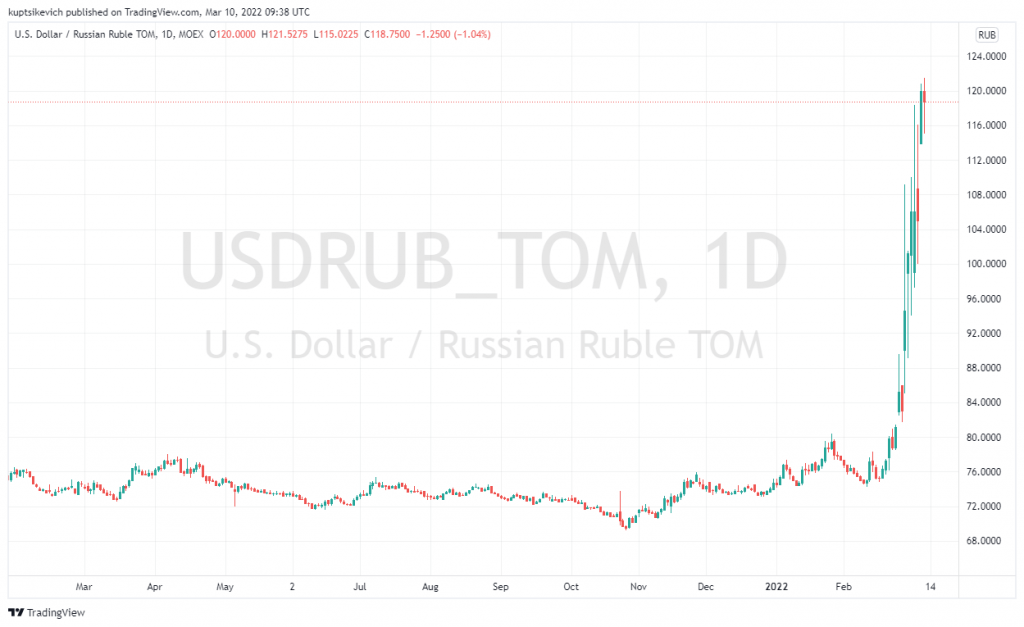

The Russian rouble has been on the decline, trading around 120 per dollar on the Moscow Exchange and making historic lows almost daily.

Despite ever-increasing capital controls, the Russian currency is still unable to find a bottom, as tighter controls are only further discouraging buyers of the rouble. It would be logical to expect the opposite effect from restrictive measures on the Russian population, as desperate attempts to limit currency purchases only increase the feeling that the government has no control over the situation.

Remembering the hyperinflation of the early 1990s, ordinary Russians and businesses are looking at hard currency as a last resort to save liquidity for a rainy day. Recent data on consumer activity also showed a surge in buyers. The initial drivers were not the mass exodus of foreign brands from the Russian market but the desire to spend the rapidly depreciating roubles.

By the end of this week, this trend promises to become stronger, fuelled by the severest restrictions on capital controls in recent history, which do not allow the legal exchange of roubles for currency.

In such an environment, it is difficult to expect the rouble to find a foothold before all sanctions on Russia are announced, and capital controls turn towards easing or go into fine-tuning mode.

The FxPro Analyst Team