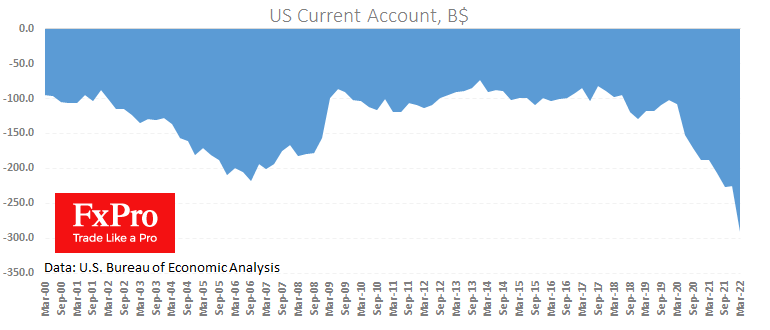

The US Current Account deficit hit a new record of $291.4bn in the first quarter. America is benefiting from higher oil prices, which helped exports rise by $13.9bn to $487.4bn. But the gain in imports was more than five times higher at $71.1bn to $829.7bn, driven by an overall increase in industrial supplies and materials.

Rapid expansion in domestic demand underscores the strength of economic growth and is another factor in favour of the Fed’s further monetary policy tightening to prevent overheating.

But at the same time, the extreme expansion of the current account deficit is playing against the USD. Despite the high USD exchange rate against a trade-weighted basket of major currencies, capital flows out of the USA.

The Fed may need to take further aggressive steps to tighten monetary policy to attract capital into the country with higher yields at the expense of economic growth.

The FxPro Analyst Team