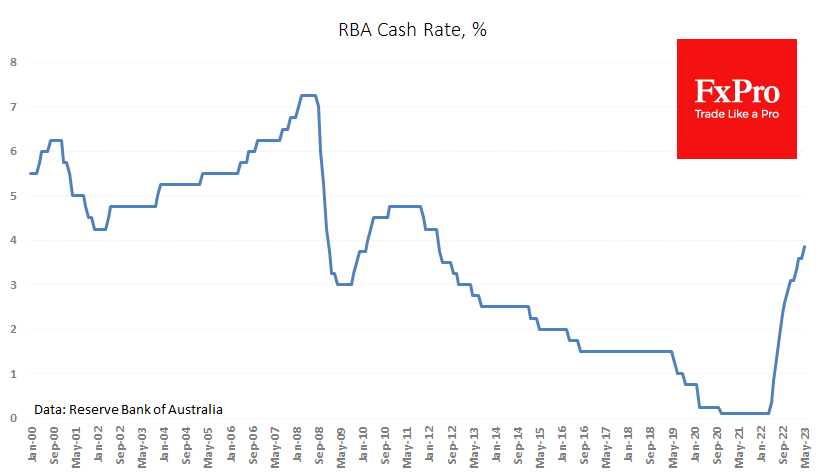

The Reserve Bank of Australia surprisingly did what it promised to the markets. The RBA this morning raised the rate by 25 points to 3.85%, warning that it may further tighten monetary policy. The Bank had previously urged markets to be prepared for such a move, but analysts and traders did not expect the change.

As a result of the “surprise”, AUDUSD gained more than 1.3% in the three hours after the decision was announced to 0.6715, rolling back to 0.6690 at the time of writing. The AUDUSD has been trying to form a ‘bottom’ below 0.66 for the past two months, and the RBA decision creates the necessary positive momentum that has a high chance of starting a trend in the coming days.

The pressure on the Aussie in the last hours has more to do with general market wariness, where there is a pull into defensive assets and the dollar ahead of the Fed decision tomorrow evening. A quarter-point rate hike is also expected there. The RBA’s latest move seems like an attempt to curb the widening of yield spreads between Australia and the US and support the Aussie.

The strengthening of the domestic currency can curb inflation, which stood at 7% in the first quarter, a sharper-than-expected decline from a peak of 7.8% a quarter earlier.

Now the AUDUSD is trying to consolidate above its 50-day moving average. An ability to close the day above 0.6685 would make a test of the 200-day moving average (currently at 0.6730) an issue. The ability to consolidate above would be an essential signal of a long-term trend reversal. However, one should remember that a similar signal triggered the AUDUSD to rise for the next three weeks in January but gave up all gains later.

The FxPro Analyst Team