Yesterday’s session was quite after a pickup in volatility last week and there has been little in the way of movement overnight. This is despite some negative headlines that possibly sapped some of the market strength over the last 24 hours. Crude Oil has continued to fall with WTI reaching $64.50 as supply increases and reserves rise. The decline has been dramatic with prices at a high of $72.80 only two weeks ago.

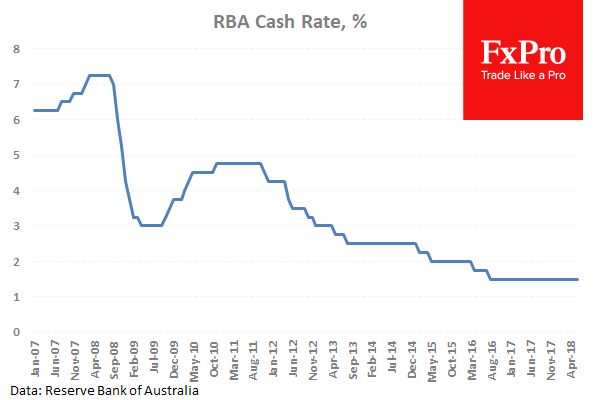

Iran has said that they will increase capacity to produce uranium gas after the US pulled out of the Iran deal last month. The RBA has left rates on hold at their meeting saying inflation is likely to remain low for some time and household consumption remains a source of uncertainty. AUDUSD rallied from 0.75800 yesterday to 0.76660 but fell back to 0.76255 after the decision.

UK Construction PMI (May) was out at 52.5 against an expected headline number of 52.0. The recovery from the low created in April at 47.0 stalled and matched the previous read last month. The construction industry is seen as being under a degree of pressure since the high levels of 2014 but has recovered somewhat. GBPUSD moved higher after this data release from 1.33560 to 1.33982.

Eurozone Producer Price Index (YoY) (Apr) was 2.0% against an expected 2.4% from a previous 2.1%. The recovery in the Euro area is weaker but growing despite some sluggish economic data.

US Factory Orders (MoM) (Apr) were -0.8% against an expected -0.3% from 1.7% previously. The drop shows a decrease in demand for US produced goods.

EURUSD is down -0.10% overnight, trading around 1.16852. USDJPY is up 0.07% in the early session, trading at around 109.891 GBPUSD is down 0.02% this morning trading around 1.33119. Gold is down -0.08% in early morning trading at around $1,290.91. WTI is up 0.11% this morning, trading around $64.98.