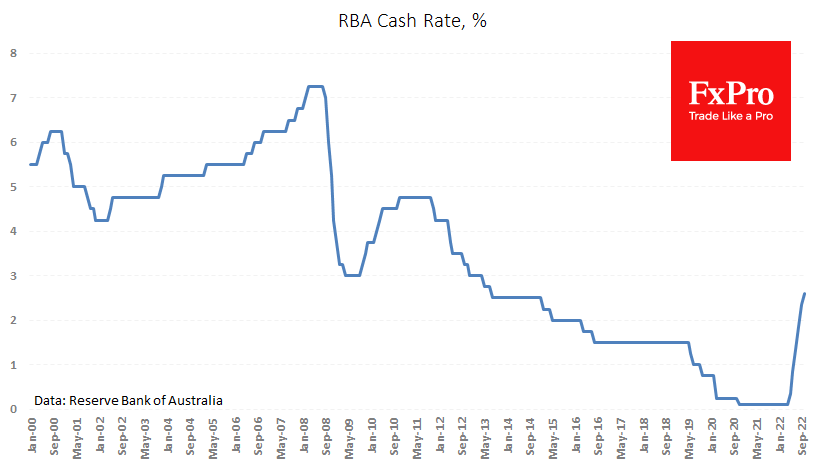

The Reserve Bank of Australia raised its rate by 25 points to 2.6%, against an expected increase to 2.85%. Previously, the rate had been hiked by 50 points four times since June. The same decision was also predicted by the market this time.

In the commentary on the decision, central bank governor Philip Lowe argued that more hikes were necessary. However, the fact that the RBA has moved ahead of many central banks from developed countries to fine-tune monetary policy has triggered sudden selloffs.

The AUDUSD pair lost 0.8% to 0.6450 on the surprise from the RBA, but on the back of general optimism in the markets, the pair rocketed higher, reaching 0.6550 at one point. At the time of writing, AUDUSD is trading near the day’s lows again as traders overestimate the outlook for monetary policy.

The macroeconomic picture in Australia hardly justifies a move to such fine-tuning, with unemployment near half-century lows and inflation projected at 7¾ with a target of 2-3% in 2022.

Between 2001 and mid-2008, the Aussie was one of the favourite chips in the carry trade game, thanks to the RBA’s high rates, trade surplus and impressive economic growth. The RBA’s move of monetary policy from a run to one of the first among peers and at lower rates than in the US risks turning the Aussie into a lame duck.

This sudden rate cut also calls into question the AUDUSD’s ability to recover quickly from the 0.6500 area as it has for the past 20 years. It now seems that only a similar slowdown in policy tightening from the Fed could keep traders’ interest on the Aussie side, and we should watch closely to see if the RBA knows something the rest of the world doesn’t see.

The FxPro Analyst Team