The Australian dollar lost 1.6% yesterday during the European session, dropping from 0.7320 to 0.72. Today a new wave of decline was launched by RBA Deputy Governor Guy Debelle. In his speech, he considered possible options for the Central bank to further support the economy.

These included FX interventions, negative rates, and to buy bonds further along the curve. The latter option seems the most likely and least risky for the Aussie Dollar.

However, the very fact that RBA is considering new support methods and is talking about the benefits of a lower exchange rate has alerted buyers of the Australian currency.

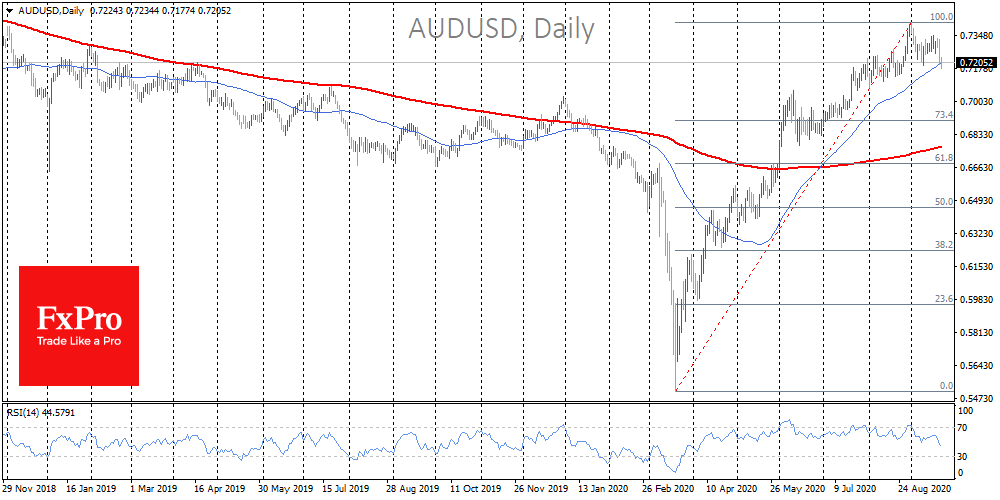

AUDUSD on Tuesday updated it’s one month low at 0.7180, following many other risk-sensitive instruments testing a 50-day average. The result of this bull and bear battle will define whether there will be an early development of the correction to 0.70, or a retest of highs above 0.74.

The FxPro Analyst Team