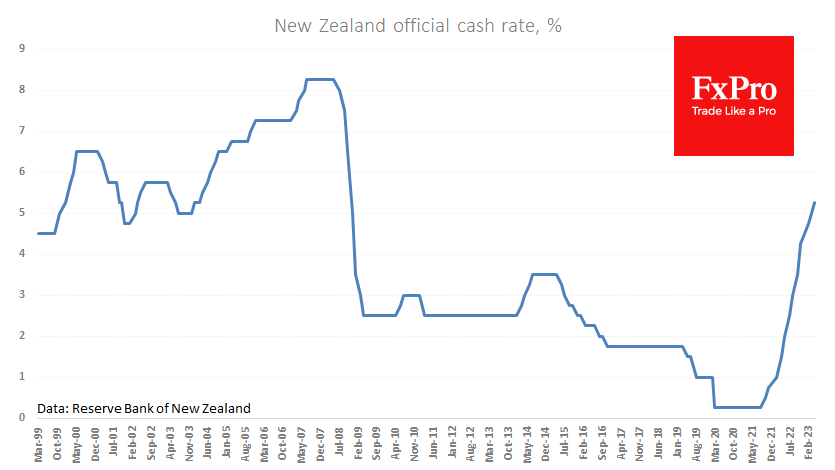

The Reserve Bank of New Zealand made another rate hike of 50 points to 5.25%. Contrary to forecasts of a 25-point rate hike and the global trend towards a slowdown in policy tightening, the RBNZ has not slowed down a step. In this cycle, the rate has already been increased by 500 points.

A higher-than-expected rate hike caused the NZDUSD to rise 1.2% within a minute to 0.6378. However, a few minutes later, the excitement for the New Zealand currency eased, and the pair almost erased this rise, returning to the 0.6310 level at the start of the day.

In our view, the pressure on the NZD was due to hints that this could be the end of the RBNZ’s hike cycle, suggesting a slowdown in domestic demand and normalisation of domestic price pressures as the weather in the north of the country normalises.

The NZDUSD has maintained an upward trend for almost a month, receiving support from increasingly higher levels. We consider the smooth reversal to the upside in the pair in March from the 200-day average line as a milestone. On Monday, the Kiwi crossed above its 50-day average, which is also a signal that Today’s intraday trend shows that the bulls cannot increase the momentum of this trend.

Despite a strong sell-off shortly after the rate decision, the NZDUSD doesn’t look overbought, and there are no significant resistance levels until the area of 0.6500.

And the Kiwi might continue. The pair had an almost canonical Fibonacci retracement from the October-January rise in February and early March and has been moving gently upwards since then, with the potential to reach 0.70-0.71 before the end of the year.

The FxPro Analyst Team