Market Picture

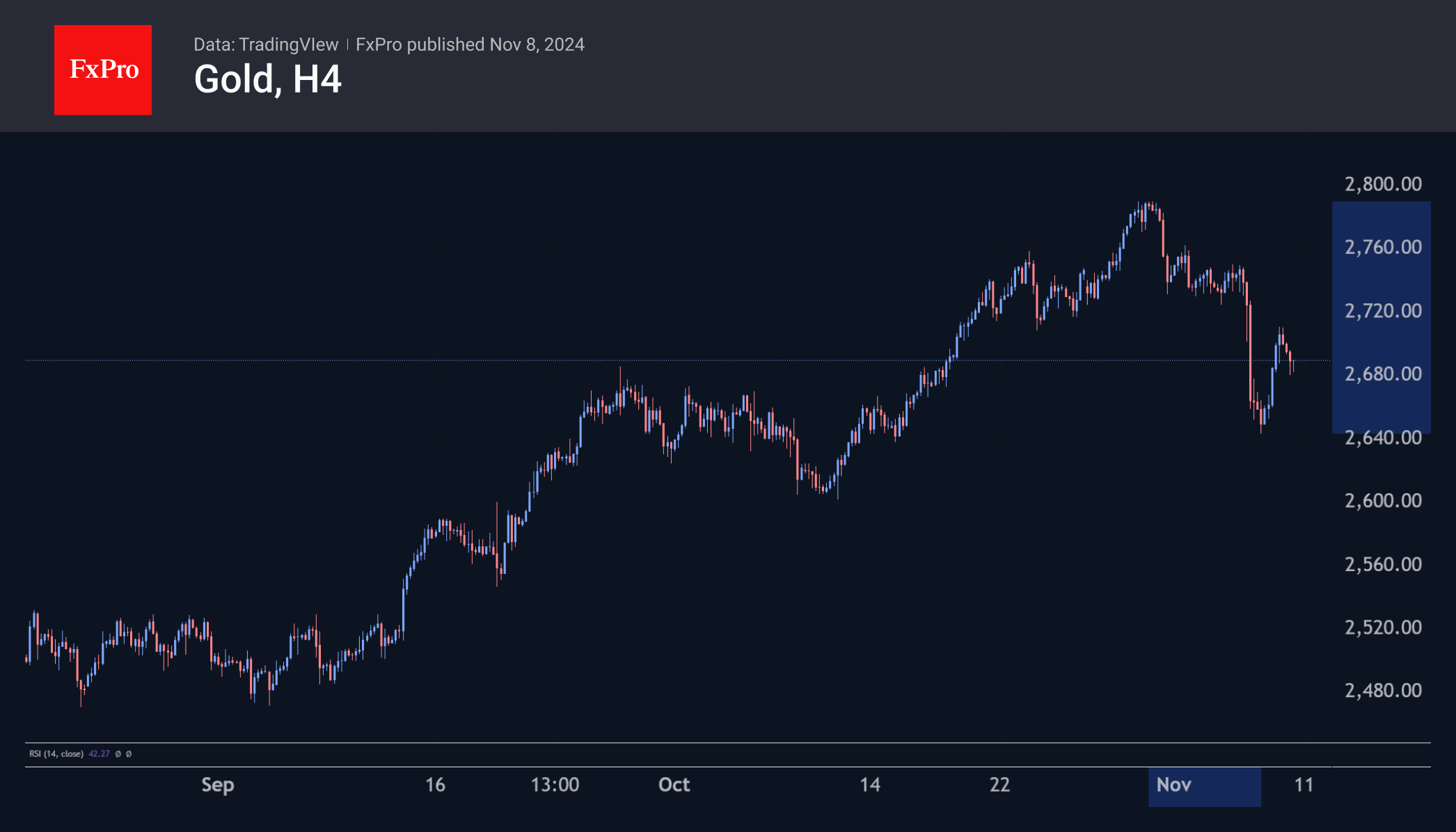

Gold lost over 3% in value on the day the presidential election results were tallied. Cumulatively, from the peak in late October to the recent low, the losses exceed 5%. So far, it does not look like a tragedy. On Thursday, the price added 2.5% from the lows to the high intraday, recovering most of the decline from the day before.

Technical Analysis

Gold has found support in the form of the 50-day moving average just below $2650. This correction removes the overbought accumulated conditions from nearly three months of previous gains.

Although gold rebounded encouragingly on Thursday, we doubt further gains in the coming weeks. We attribute Thursday’s recovery to gold bugs attempting to join the general pullback into risk assets, reinforced by the temporary pullback in the dollar that day.

We do not rule out a deeper decline in price, correcting more than 50% of the rise from the lows of last October. Some capital parked in gold in recent months while the dollar strengthened, as it was a drag from risk. Now, gold may be in for a reversal.

The start of the corrective movement is confirmed by the return of the RSI on weekly timeframes from extreme overbought with values above 80.

The growth of the dollar may accelerate the global correction, but even without it, precious metals may face challenges.

Stages of Decline

In the short term, we highlight several stages of decline. A consolidation under $2640 will mark the break of support in the form of the 50-day moving average and the deepening of the correction under the traditional 61.8% retracement from the August lows.

The next leg of the decline is seen as a correction to the $2400 area, where the 200-day moving average and the starting point of the last growth phase are centred.

From a more distant perspective, we see impressive chances of price pullback in the $2000 area. In this case, the previous area of highs may act as a global support.

A sharp return to growth will allow us to discuss the imminent renewal of historical highs. That is a real but alternative scenario. It seems to us that there is now more chance that gold will leave the top role for a while.

The FxPro Analyst Team