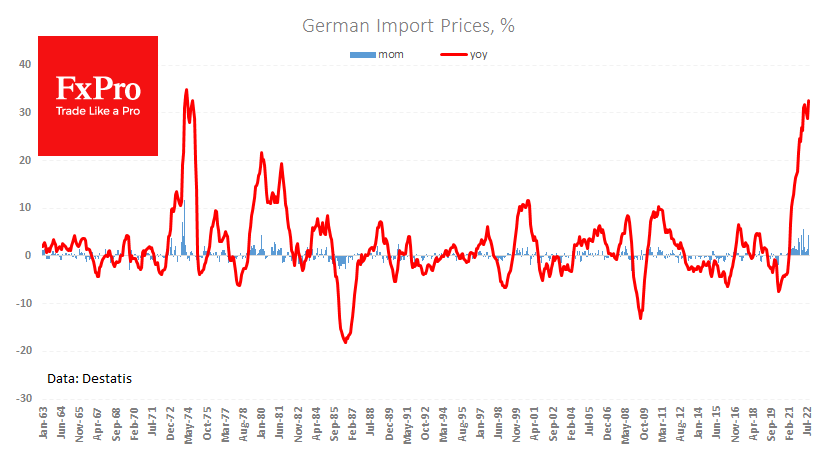

Import prices in Germany jumped by 4.3% in August, dashing hopes of waning inflationary pressures. The year-on-year growth rate has accelerated from 28.9% to 32.7%, marking a new record since 1974 – another consequence of the single currency’s weakness.

Retail sales for the same month declined by 1.3% m/m and 4.3% y/y on an inflation-adjusted basis. A logical reaction of consumers to the increase is to increase their purchases to spend the money before it loses its value. However, this theory is more suitable for periods of an economic boom in developed and poor developing countries with a high proportion of necessities in the consumer basket.

The persistence of the inflation shock, which can be seen in the development of import prices, may also be pushing the euro region’s monetary watchdogs to accelerate their rate hikes.

The EURUSD, after an initial 35-pip slide following the German statistics package, returned to the upside, reaching new highs for the day above 0.98.

The FxPro Analyst Team