Often the release of fundamental data such as oil inventories and production or economic activity influences the market, although sometimes the price behaves independently, as was the case last week. The cost of a barrel of WTI fell by 2% last week, despite an initial rise of 3%, and has now fallen in seven of the last eight weeks.

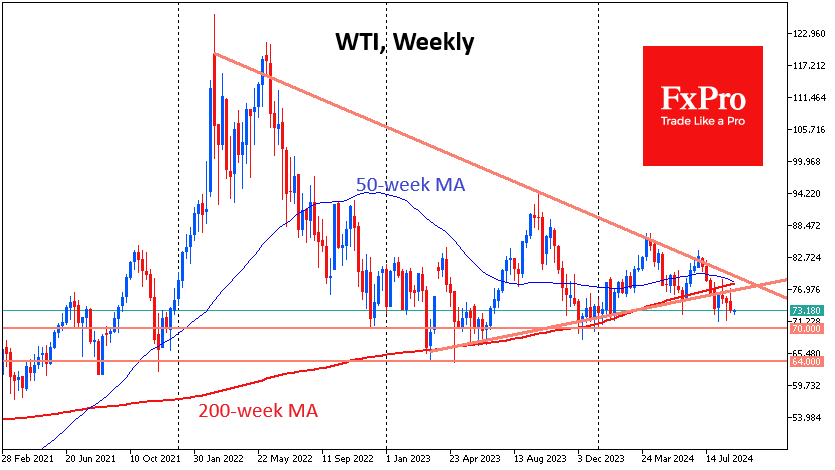

The technical picture is also negative, with the 50-week moving average about to fall below the 200-week moving average, forming a ‘death cross’. This comes after oil broke out of a more than two-year consolidation triangle. These signs point to significant selling pressure, which has so far been contained by a long-term support level of around $70 per barrel of WTI. A break of this support would open the way to extreme lows of $40 or even $30, where the price has been in previous global collapses.

However, from a fundamental point of view, it is still difficult to expect such a collapse. The number of oil rigs in the US is at 483 for the third week. This is low by historical standards and does not suggest an explosion in production over the next 2-3 quarters. Actual production fell from historic highs to 13.3M BPD.

Commercial oil inventories fell by 0.85m barrels last week to 425.2m, 0.5% higher than a year ago and within historical norms. All of this comes against the backdrop of positive surprises in private consumption data and upward revisions to Q2 GDP figures.

The situation in the gas market is not the best either. While the price is receding from this year’s extremes, it is still close to the cyclical lows of the last 25 years, and inventories are at the upper end of the range of the last five years.

Coal-fired generation recently fell below renewables for the first time in history. This is putting pressure on the price of fossil fuels, even though the pace of the green transition has slowed.

It seems the time has come to recall the words of a Saudi politician in the 1970s, Sheikh Yamani: ‘The Stone Age came to an end not for a lack of stones, and the Oil Age will end, but not for a lack of oil’.

The FxPro Analyst Team