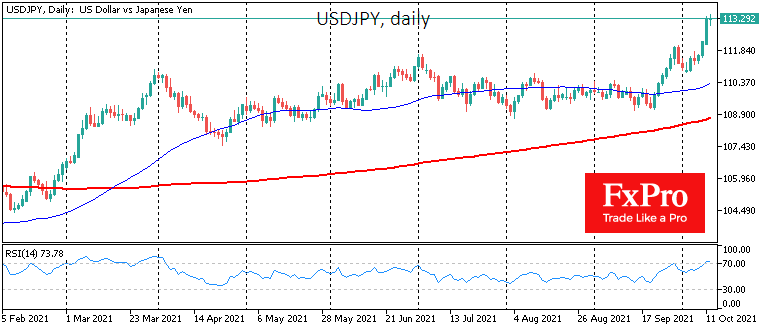

The Japanese yen has collapsed by more than 1% to 113.50 in the past 24 hours, the biggest intraday gain since November last year and sending the pair to its highest since December 2018.

Often the pressure on the yen is a sign of a recovery in demand for risky assets, as investors shift out of the country’s low-yielding bonds in the expectation of rising yields. But yesterday’s case stands out of that line. The weakening of the yen came along with pressure in the US and Chinese stock markets. Moreover, Japan’s Nikkei225 is losing 0.75% today, reducing this week gains to 0.77%.

Technically, the pressure on the Nikkei225 intensified as it approached an area of the 50- and 200-day moving averages convergence near 28800, marking bearish dominance now. From current levels at 28300, short-term traders should pay attention to the limits of the recent trading range at 28800 and 27000. A move beyond these boundaries could be a sign of surrender by one side, reinforcing the amplitude of the breakout.

The fundamental drivers for Asian and, to a large extent, Europe, energy prices are a significant factor. Although gas prices have retreated from record levels, oil and coal prices continue their climb to multi-year highs. Prices and pace of its growth have surpassed levels typical for healthy economic growth, and markets are beginning to worry about the impact of expensive energy on the economy. In this environment, rising oil and gas prices are putting pressure on stock bourses in energy-importing countries. However, it is easy to find historical examples when falling energy prices were a drag.

Practice shows that the festive mood among energy producers and exporters rarely lasts long. Very soon, the balance of power shifts in favour of consumers.

Separately, Chinese markets remain heavy, once again hit by a sell-off due to headlines that the country’s government is seeking to legally restrict the expansion and profit growth of internet companies, as well as investigating links between banks and financial firms with private companies. Chinese indices have returned to last week’s closing levels, and European and US index futures have lost 1.0-1.5% since the start of the week.

The FxPro Analyst Team