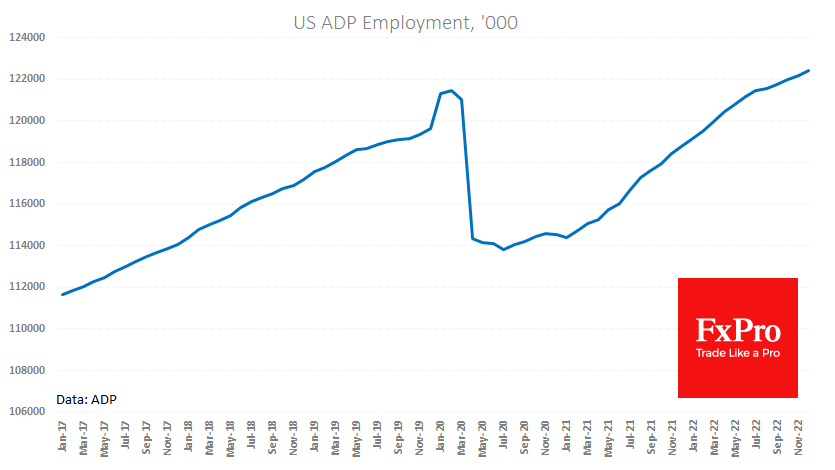

The ADP said the US private sector added 235K jobs in December in a report ahead of tomorrow’s official data release. The market expected an increase of 150k after a rise of 182K a month earlier. The ADP commented on the last report as a turning point, noting a decline of 100k in the manufacturing sector.

This time, observers pointed to a jump in employment in small and medium-sized companies while large companies were downsizing. This is a typical story of small businesses being the first to adapt to changing conditions.

Weekly jobless claims also came as a positive surprise. Initial claims fell to 204k against 223k a week earlier and an expected increase to 230k. The number of repeat claims fell from 1718k to 1694k, stabilising over the past five weeks.

Wednesday’s published job openings data also came in better than expected, showing 10.46 million openings – much better than the 10.0 million expected.

The publication of robust data was further boosted by comments from Esther George, who said she had raised her benchmark rate forecast for this year above 5% and kept it at its peak until at least 2024. The bullish news set the dollar index up 0.75% in a couple of hours and is now trading near 104.80, its highest level since December 12.

The technical picture is beginning to look more and more like the start of a new dollar momentum after the corrective pullback from late September to mid-December.

The FxPro Analyst Team