- The US dollar is falling as a safe-haven asset amid growing risk appetite.

- Gold is performing well, but other assets in the sector are looking even better

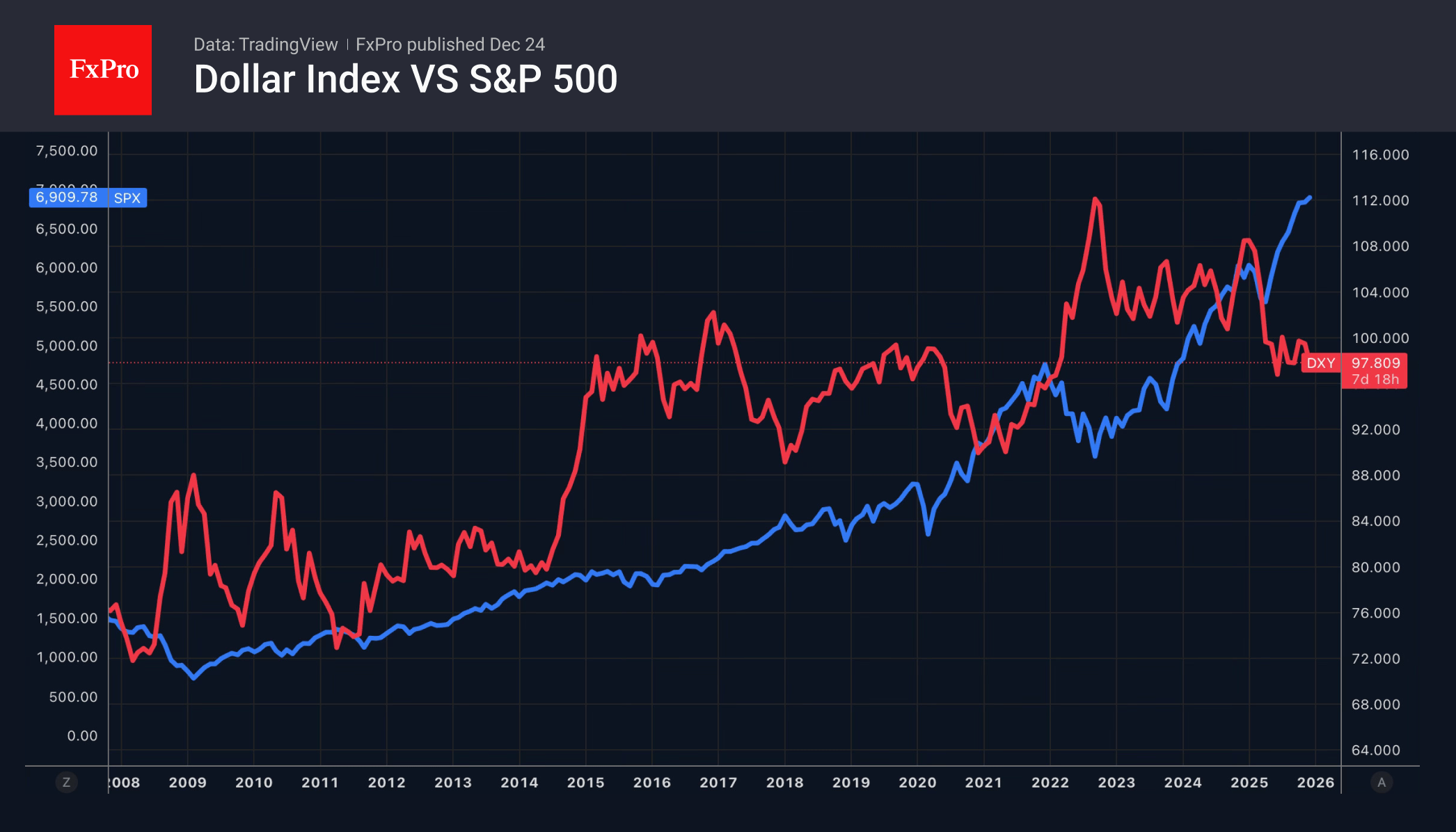

GDP growth of 4.3% in the third quarter did not help the US dollar. It would seem that the strength of the economy, the rise in Treasury bond yields and the decline in the likelihood of the Fed easing monetary policy in March to less than 50% should have cooled the hot heads of the EURUSD bulls. However, greed reigns supreme in the financial markets. The S&P 500 closed at a record high, which had a negative impact on the USD index.

Donald Trump was encouraged by the success of the US economy, citing tariffs as the main reason. The president said that the new Fed chairman would cut rates if the market was performing well. Investors should be rewarded for their success. Support from the White House is helping US stock indices, improving global risk appetite and reducing demand for the dollar as a safe-haven asset.

In such conditions, high-yield currencies feel most at home. The British pound reached a three-month high against the greenback, and the Australian dollar reached a 14-month high. After the Reserve Bank signalled the end of the monetary policy easing cycle, the futures market began to price in expectations of a cash rate hike in 2026. By Christmas, the start date for monetary tightening had shifted to June, which created a tailwind for AUDUSD.

Investors in a Bloomberg survey see the Bank of England’s neutral rate at 3.25% and estimate the chances of it falling to 3% in 2026 as fifty-fifty. They are more dovish than the BoE. At their December meeting, Andrew Bailey and his colleagues opted for caution, which supported GBPUSD.

Meanwhile, gold has broken through the psychologically important level of $4,500 per ounce. JP Morgan forecasts XAUUSD to rise to 5,000 by the end of 2026 and estimates the scale of bullion purchases by central banks and retail investors at 585 tonnes per quarter. According to the bank, every 100 tonnes above the base 350 tonnes leads to a 2% increase in precious metal prices.

Gold has already gained more than 70% in value in 2025 and is heading for its best performance since 1979. Other assets in the precious metals sector are growing even faster. Prices for silver, platinum and palladium have more than doubled this year. Along with strong investment demand, fears about the introduction of US import duties are playing into their hands.

The FxPro Analyst Team