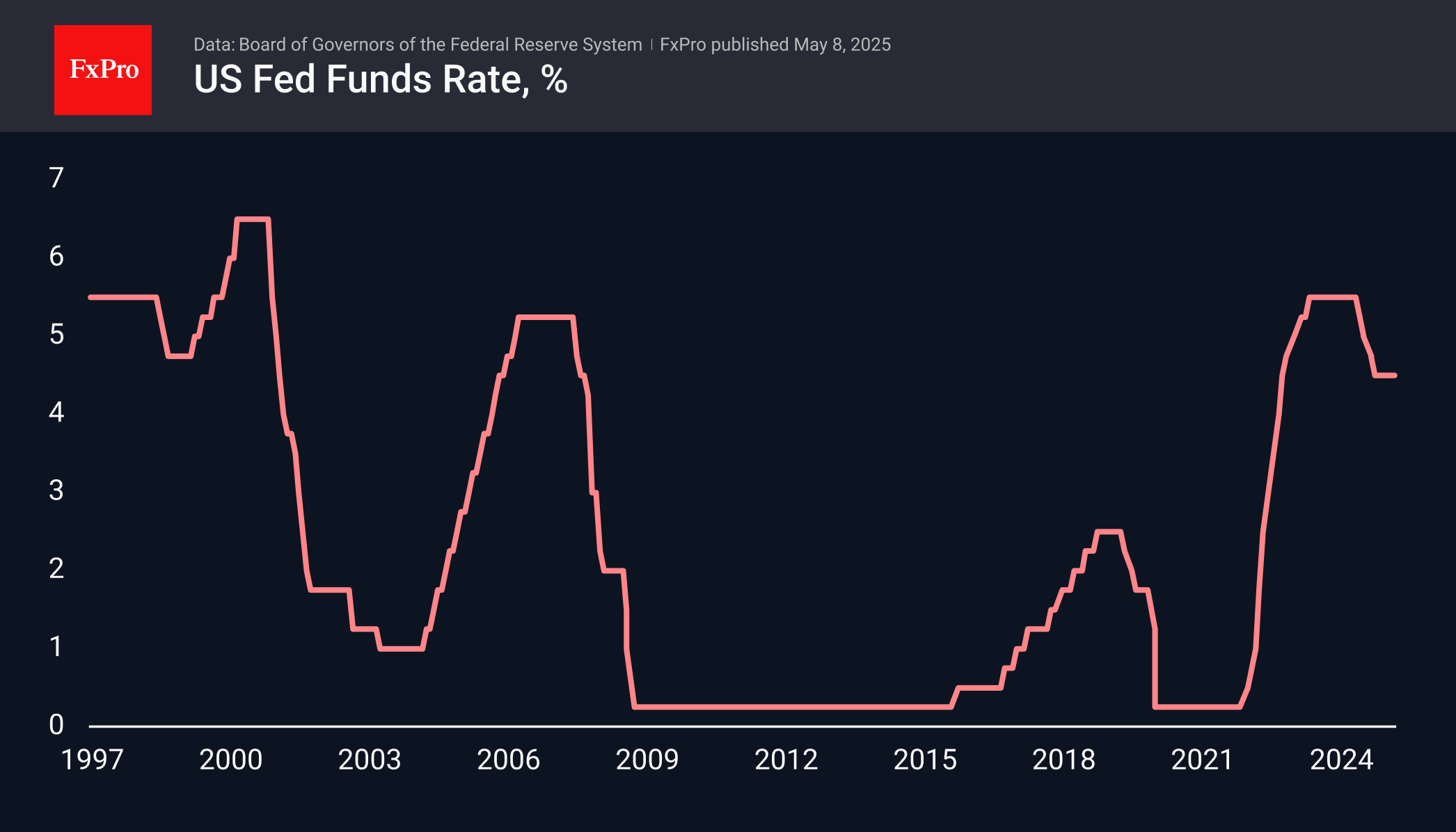

The Federal Reserve left the key rate unchanged and expressed its intention not to hurry with its reduction. Powell noted the intensification of inflationary pressures and possible risks of unemployment growth, as well as the fact that the duties are still higher than expected. At the beginning of his speech, the Fed chief emphasised several times that there was no rush to change rates. Such statements are in line with the trend of recent weeks, when traders were revising their expectations for the next policy easing.

The day’s changes in the numbers were not significant. The probability of three or more rate cuts before the end of the year (main scenario) is almost 70%, up from 75% the day before. This is in sharp contrast to nearly 92% a month earlier. The Fed chief’s comments point to the possibility of a further shift in expectations towards higher rates before the end of the year.

Powell emphasised that the next steps depend on the White House’s rate policy. Active selling of US stocks and bonds weakened the dollar amid news of escalating tariff threats, significantly impacting the economy.

Overall, Powell’s comments helped support the dollar, which has lost more than 11% in four months, hitting a three-year low during one of the most intense selloffs of recent years. Such declines were last seen in 2018 amid the first trade war episodes.

The FxPro Analyst Team