After nearly a month of strengthening against the dollar, the British pound is encountering strong resistance. Speculative interest in the British currency is shrinking as more hawkish Fed rhetoric is being put into the GBPUSD quotes in recent weeks as the Bank of England is no longer looking so hawkish.

In addition, locally, the pound looks somewhat tired after an impressive rally, having added 4.3% in the last month. The pause in the pound’s rise is seen as a desire by market forces to look around and assess further prospects.

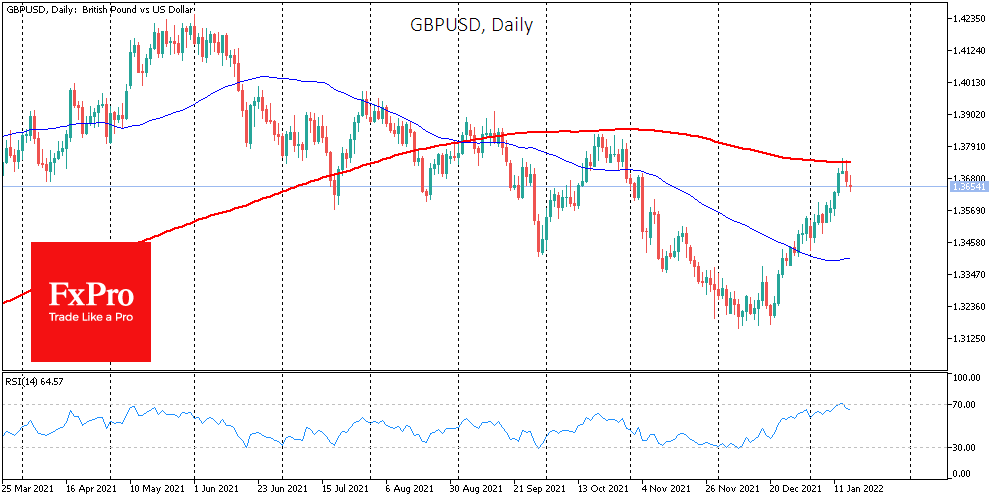

The GBPUSD rally stalled at the end of last week as it tried to develop a rise above 1.3700, near where the 200-day moving average runs. Since September, this curve has acted as a resistance level, indicating that bearish sentiment prevails.

Locally, the chances are pretty high that a corrective pullback in the pound will continue as the markets reassess the hawkish sentiment of the Fed. The baseline scenario for 2022 assumes four rate hikes already. Few developed country central banks will keep up with that pace.

Nevertheless, the pound may fare better than other developed country currencies in the outlook for the year compared to the dollar. The Bank of England has shown a willingness to act quickly. In addition, history suggests that in periods of high inflation and rising house prices, it actively raises its key rate.

Unlike the weak Eurozone, Britain has a chance of not only catching up but overtaking the US in key rate levels over the next three years, providing an influx into GBPUSD.

The EURGBP pair has started the year near the bottom of a wide range over the last 5.5 years. And in the coming months, we could well see a move down out of this corridor with the lower boundary at 0.8350, aiming for 0.78 by the end of the year.

The FxPro Analyst Team