Disappointing economic data from the UK prevented the Pound from rallying despite the Dollar’s weakness. Statistics for July showed that the economy’s volume was almost unchanged from the previous month, much weaker than the expected 0.2% m/m growth.

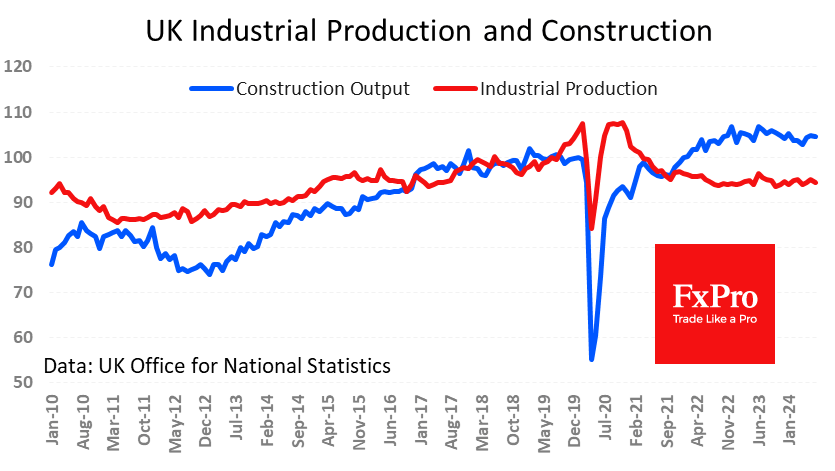

The biggest negative surprise came from industrial production. The industrial production index fell by 0.8%, reversing the previous month’s surge and going against expectations of 0.3% growth. On an annualised basis, the decline was 1.2% against expectations of 0.2%. Manufacturing contracted by 1.0% m/m and 1.3% y/y.

The trade deficit widened to 20 bn from 18.9 bn in the previous month. Expectations that falling energy prices would reduce the deficit to 18 bn have not materialised so far. The UK only ran a larger monthly deficit from January to June 2022.

It will take several months for the first interest rate cut of this cycle to work its way through the economy. However, the weak data reinforces our expectations of further policy easing. While markets are, on average, pricing in another cut in November, we would not be surprised to see such a move at the next meeting as early as next Thursday. The Bank of England has shown time and again that it prefers to start earlier and do less rather than delay the start and end up doing more. Today’s data adds to the downside risks for the Pound, but whether this translates into GBPUSD declines depends heavily on US news and Fed policy.

The FxPro Analyst Team