Positive news for the Pound, beyond the fact that England will play in the Euro-24 final. The monthly estimate showed that the economy grew by 0.4% in May (twice as much as expected) and that growth in the last three months accelerated to 1% year-on-year. That’s the fastest pace since early 2023, although it’s about half of what it was before the pandemic hit.

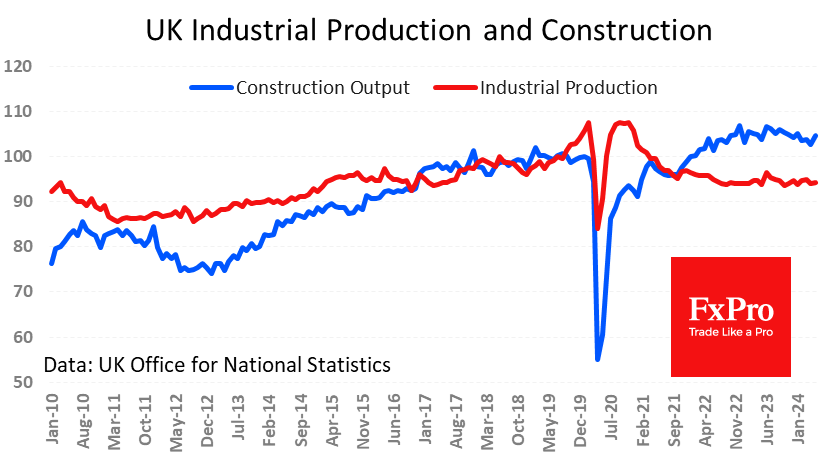

The services sector continued to drive growth, adding 1.1% over three months. Meanwhile, the construction sector added 1.9% in May (vs 0.5% expected), shifting from -2.1% y/y to +0.8% over the month. Construction and services are non-tradable sectors, and the current situation points to very healthy domestic demand.

It’s a different story for industry and trade. Industrial production rose by 0.2% in May, a slight rebound after a 0.9% drop in the previous month. The year-over-year gain is 0.4%, extending the index’s stagnation to almost two years after two years of decline.

There is also disappointment in the performance of foreign trade, with the value of exports falling to its lowest level since January 2022 at £29.6 billion, the level the UK saw five to six years ago. Imports fell over the month but remain high by historical standards at 47.5B, which is 10% above the average five to six years ago.

So, the current monetary regime moderately restricts services and construction but suppresses industrial production and exports. Inflation is the Bank of England’s priority, so the continued expansion of the services and construction sectors, which together account for around 90% of GDP, may force the central bank to tighten monetary policy in the coming quarters.

This news is a driver for the pound as it tests 12-month highs and a key long-term trend line, the 200-week moving average against the dollar. A potential break above this resistance could open the way to the next leg of the 1.35-1.40 range.

Just as much attention is being paid to the EURGBP, which is making its second plunge to 2-year lows in a month and looks vulnerable to further Euro retreats ahead of the Pound. The pair is now trading near 0.8420 with the potential to test 0.8300, the lower boundary of the important 8-year range.

The FxPro Analyst Team