The British pound failed yet another attempt today to break above 1.3300, despite help from macroeconomic data. However, regardless of the fail in this local battle, the strong growth in retail sales allows us to look at the pound with some optimism.

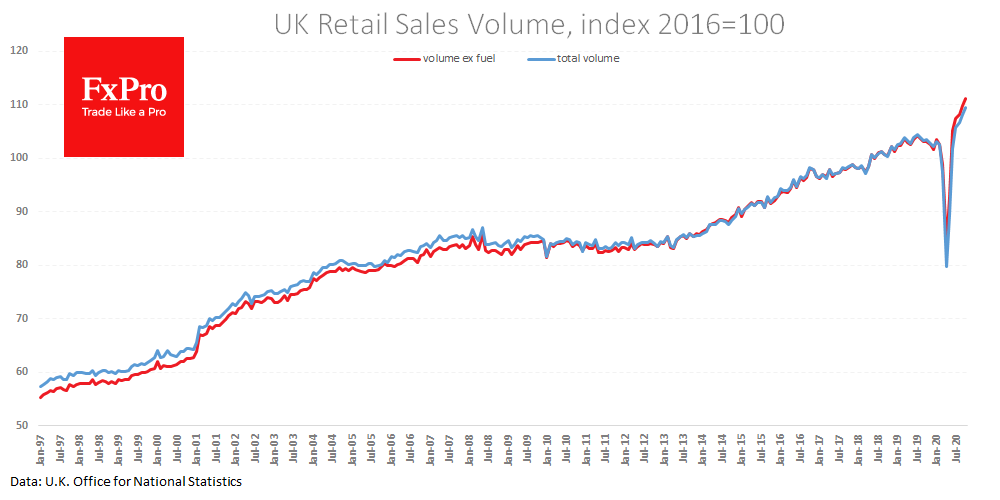

The latest report showed retail sales grew by 1.2% in October and 5.8% from the same month last year. This is distinctly better than the forecasted drop by 0.3% m/m and a slowdown to 4.2% YoY from 4.6%. Sales ex-fuel added 7.8% YoY in October.

Post-publication pressure on GBPUSD could prove to be a temporary tug on the dollar on Friday and a reluctance to cross the psychologically important 1.33 by the end of the week.

It is interesting to see whether GBPUSD will be the first to go beyond the established range of recent years or if it will confirm its resilience.

The FxPro Analyst Team