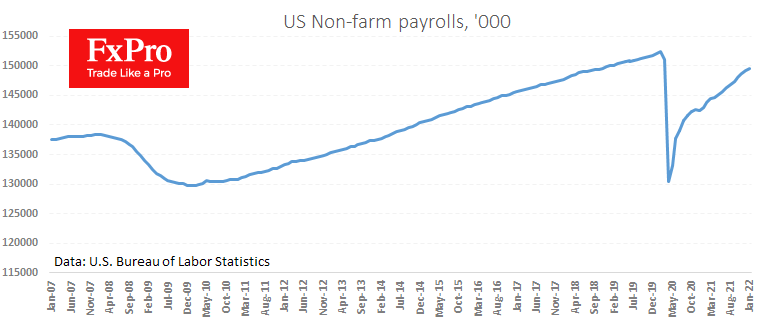

A positive surprise on US employment. The official BLS report showed a jobs increase of 467K, markedly better than the expected 110-165K. Moreover, the previous data was seriously revised upwards and now reports employment growth of 510K in December compared to the initially reported 199K.

Average hourly earnings rose by 0.7% m/m and 5.7% y/y, showing further acceleration and increasing signs that the inflation genie is out of the bottle.

As a result, markets are intensifying their expectations for policy tightening, laying a 34% chance of an immediate 50-point rate hike in March versus 18% before the release.

The strong labour market and the mood for decisive rate hikes also support the dollar, which adds 0.4% after the release. This is likely that the USD growth impulse is far from the end, and dollar growth will continue in the coming days or even weeks.

The FxPro Analyst Team