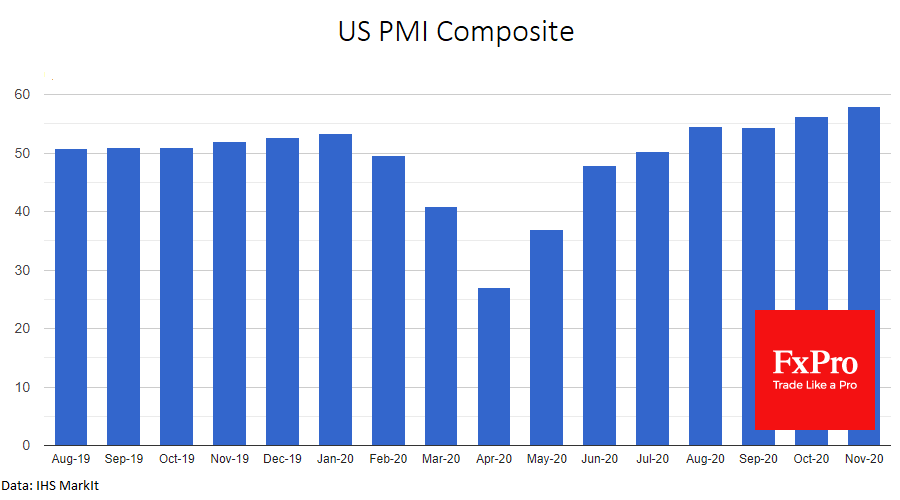

The data from the US today came as a pleasant surprise to the dollar. Preliminary PMI numbers showed an increase in the composite index from 56.3 to 57.9 against an expected drop to 54.5. Both the manufacturing and service sector activity component exceeded expectations and increased markedly from last month. This contrasts sharply with US records for daily illness, death and new lockdowns measures.

On the contrary, earlier today, European estimates were surprisingly weak. The Composite Index collapsed from 50 to 45.1.

The PMI is a significant driver for the movement of the currency and stock markets in times of high uncertainty, as it is an excellent indicator of turning points in the economy. In this case, the sharp contrast in data from Europe and the US was clearly in favour of a decline of the euro against the dollar, as we see in the first minutes after publication, EURUSD is once again not rising above 1.1900.

The FxPro Analyst Team