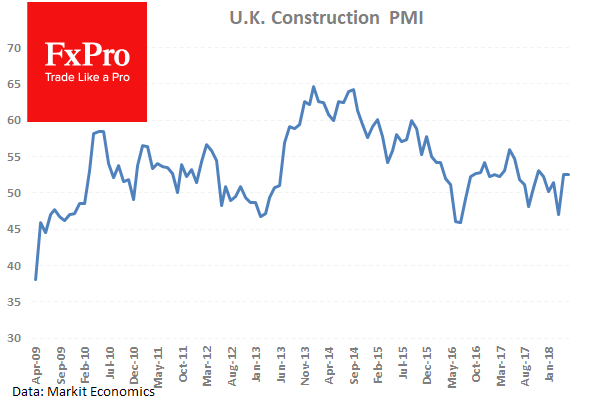

At 08:30 GMT, UK Construction PMI (Jun) will be out with an expected headline number of 52.0 from a prior number of 52.5. The consensus is for the numbers today to remain in line with expectations after the data stabilized around 52.5 for the last two months, up from the low created in April at 47.0. The industry has recovered somewhat but is well off the peak from 2014 of 64.6. GBP pairs may see an impact from this data release.

At 13:30 GMT, Canadian Markit Manufacturing PMI (Jun) is expected to be 55.4 against the previous 56.2. This data set broke above the high from February at 55.9, when it matched the April 2017 number. The expectation for this reading to fall slightly from the high, as trade tensions start to impact manufacturing planning. CAD pairs may see prices move after this data release.

At 15:00 GMT, US Factory Orders (MoM) (May) are expected to be 0.0% from -0.8% previously. This data is expected to move to zero from negative territory today. If the increase in expectations comes to pass it represents a small drop as the recent range of this data point over the last three years has been between +3% and -3.5%. USD crosses can be moved by this data.

Tentative – Global Dairy Trade Price Index is expected to be released with a previous reading of -1.2%. There have now been two negative readings in a row as Dairy prices come under pressure. NZD pairs can be affected by this data release.

At 16:00 GMT, ECB’s Praet is due to deliver a keynote speech at a Gala Dinner hosted by the National Bank of Romania in Bucharest, Romania. EUR crosses can be moved by any comments made in relation to ECB policy.