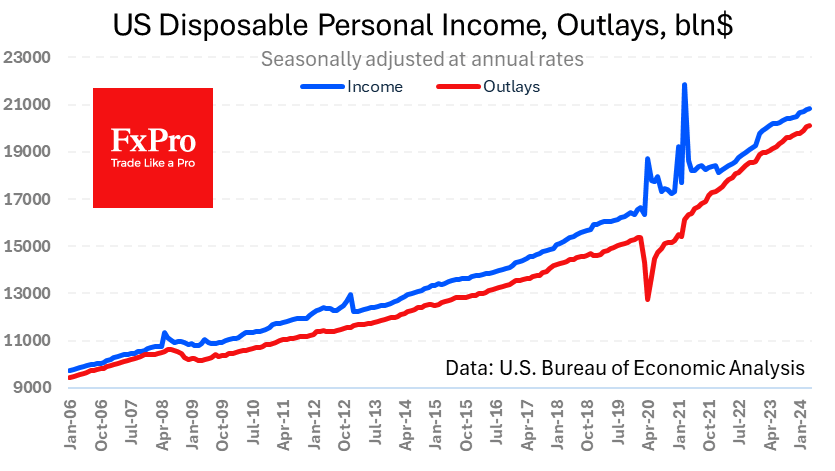

A fresh batch of important monthly data on income, outlays, and personal consumption expenditure prices in the US has been published. Personal outlays grew by 0.2% in April after a 0.7% jump a month earlier. Incomes rose 0.3% following a 0.5% increase in the previous month.

The savings-to-income ratio remained at 3.6% for the second month in a row. But this indicator has maintained its downward trend since last August. Persistently lower levels of this indicator were seen in 2005-2007 when the housing market was pulling finances out of US households. Now, the pressure is being provided by a rebound in the tax burden after pandemic-related easing.

By April last year, personal taxes had risen 10%. As a result, a 4.5% rise in personal spending over the period led to only a 3.7% rise in disposable income. Spending, on the other hand, rose by 5.5%.

The Core PCE Price Index matched analysts’ expectations, adding 0.2% m/m and 2.8% y/y. The annual rate has remained unchanged for three consecutive months, exceeding the Fed’s target. However, the lack of acceleration is good news as there were risks to this given other inflation indicators.

We believe that the main threat to markets in the coming months is a slowdown in spending by US households. These households may shift to a more cautious spending pattern amid low savings rates, repeating the 2005-2007 history.

The FxPro Analyst Team