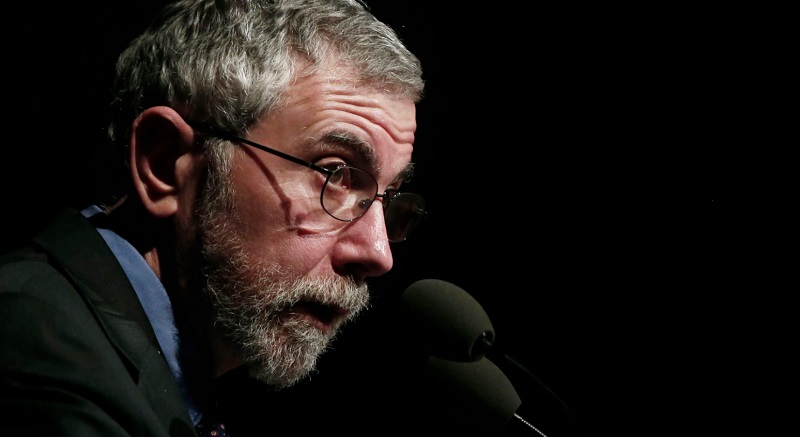

There is a decent chance the world economy is headed for a recession in 2019, according to Nobel Prize-winning economist Paul Krugman. Market participants are increasingly worried about the prospect of a serious economic downturn over the coming months, with a long-running U.S.-China trade war souring business and consumer sentiment. Most economists, as well as some the world’s business elite, agree that economic growth is slowing but policymakers have expressed some hope for a soft landing rather than an outright recession. Speaking at the World Government Summit in Dubai, United Arab Emirates on Sunday, Paul Krugman said there are good reasons to be skeptical about this scenario.

When asked whether investors should expect to see a recession over the coming months, Krugman replied: “I think that there is a quite good chance that we will have a recession late this year (or) next year.” Paul Krugman is a renowned American economist and professor emeritus of Princeton University’s Woodrow Wilson School. He won the Nobel Prize in 2008 for his work on economic geography and identifying international trade patterns.

Krugman said it was unlikely to be just “one big thing” that would prompt an economic downturn. Instead, a range of economic headwinds would increase the likelihood of a slowdown. He highlighted President Donald Trump’s tax cut stimulus as one area of concern, saying the program was “not very effective.” Krugman also warned it was “starting to look like the bubble may be deflating” when it comes to tech growth. Late last week, the European Commission sharply downgraded its forecast for euro zone economic growth in 2019 and 2020. The Commission said euro zone growth will slow to 1.3 percent this year from 1.9 percent in 2018 and is expected to rebound in 2020 to 1.6 percent.

Krugman expects to see a global recession this year, warns ‘we don’t have an effective response’, CNBC, Feb 11