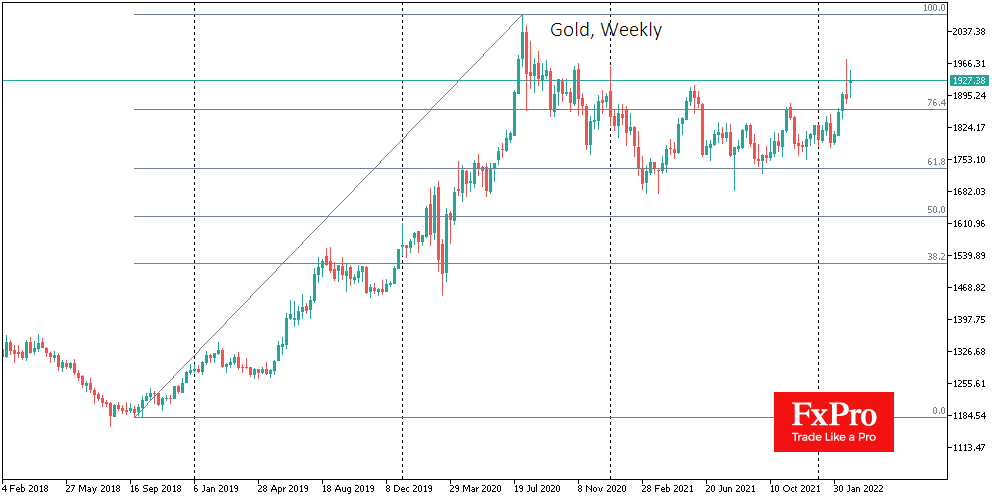

The inflow of capital into gold as a safe haven was evident throughout February, reaching its climax last Thursday when the price was approaching $1975. Since then, the uptrend has remained in place, but the price has moved away from the extremes.

There is increasing evidence that the year-long correction has been replaced by a rise, which, following the pattern of the first wave (2018-2020), could lead to a renewal of historic highs.

However, speculators’ attention has recently shifted to assessments of the prospects for metals supply due to sanctions imposed on Russia.

Palladium, about 40% of which is mined in Russia, has rallied 17% this week, and its price has risen more than 80% from the lows of mid-December, reaching $2750 per ounce, not so far from all-time highs near $3,000 set last May. Russia’s share of platinum and silver production is noticeably lower at 15% and 4%, respectively.

Problems with making payments to Russia could add to the upward pressure on metals prices, particularly for palladium. The EU and the US are focused on not exacerbating energy price increases, but metals prices, having fallen out of the focus of policymakers, could move into a phase of even wilder growth.

The FxPro Analyst Team