Market Picture

Crude oil gained around 2.5% on Monday after OPEC+ reported that it intends to delay the cartel’s production quota increase by one month from December. The November 2023 agreement calls for eight major producers, including Saudi Arabia and Russia, to voluntarily cut output by 2.2 million bpd.

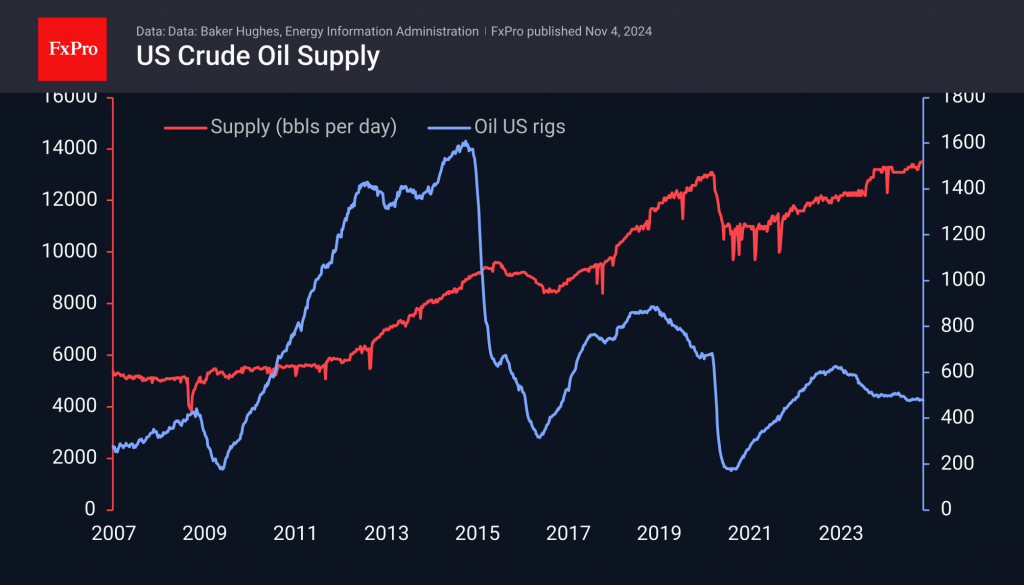

This is another attempt by the cartel to reverse the downward price trend that has been in place since April. The decline is being driven by macroeconomic factors such as a slowdown in China and sluggish European demand. On the supply side, production increases outside the cartel stand out, including the US, which has produced a record 13.5 million bpd over the past three weeks.

Natural gas inventories, the closest substitute for oil, are at a near four-year high. The moving average, which smooths out intra-year fluctuations, has reached the 2016 and 2020 highs, indicating a glut of hydrocarbons in the world’s largest economy.

The struggle between deteriorating macroeconomic sentiment and the cartel’s desire to reduce supply has been an important feature for much of this year and remains so at present. In addition to this, there is a strong growth in alternative energy sources, which is somewhat unusual at a time of relatively low oil and gas prices.

Technical Analysis

The rally at the start of the new week closed the negative gap we saw a fortnight ago following the Israeli strike on Iran. Some traders see the gap closing as a reason to sell again, especially as oil remains below the 50- and 200-week moving averages on a weekly basis, an important signal of a long-term bearish trend.

While economics usually trumps OPEC geopolitics in the medium term, the cartel’s continued efforts point to a ‘support’ price that the cartel is trying to hold. If it succeeds, key levels for the bulls will be $75 for WTI (the area of the October highs and the 50-week average) and $80 (a key round level also targeted by the 200-week average).

The FxPro Analyst Team