Events in Russia at the end of last week have once again set the stage for a price rebound from the lower end of the range seen in recent months. However, deteriorating global macroeconomic conditions leave us guessing as to ‘when not if’ we will see a break of support and a move lower.

WTI crude fell to $67.5 on Friday, and Brent briefly traded below $72.5. Previously, oil was actively involved in OPEC+ efforts to cut production (actual or planned) from these levels. This time, the rebound came from reports from Russia.

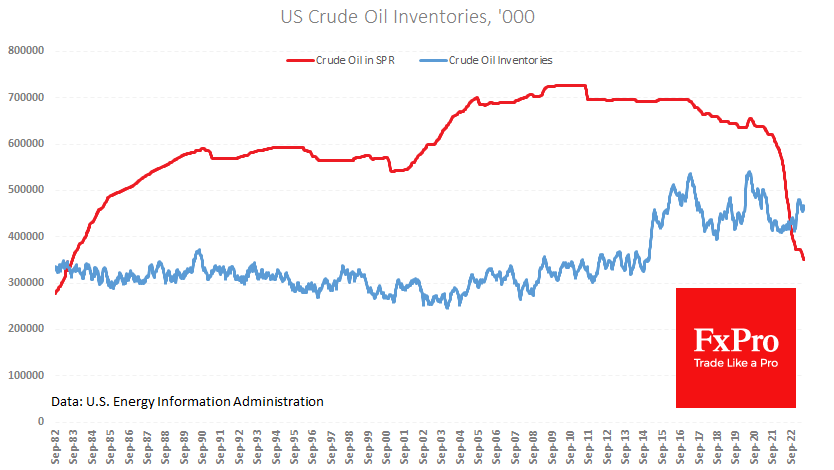

Data released in the second half of last week noted a reduction in supply, while producers were apathetic. Commercial reserves fell by 3.8mmbd, strategic reserves lost 1.7mmbd, but production averaged 12.2mmbd after a build rate of 12.4mmbd in the previous two weeks.

Friday’s Baker Hughes data highlighted the ongoing trend in drilling activity as the number of active rigs in the US fell by 5 to 682, of which 546 were producing rigs (-6 for the week). This dynamic clearly indicates the lack of appetite for upstream investment at current prices. Theoretically, it looks like a harbinger of falling production and, consequently, higher prices. In practice, however, preparing for a production surge against the highest interest rates since 2007 is hardly prudent.

WTI and Brent’s prices have repeatedly tested their horizontal support levels over the past three months. However, each time the rebounds have been less pronounced. With a few exceptions, the oil’s movements have been in a downtrend since last July, the upper boundary of which again held last week. This long-term resistance and horizontal support are rapidly approaching each other, promising a final decision on oil’s direction soon.

The downward movement of high and rising interest rates and declining economic indicators is advantageous in this battle. However, it is worth waiting for technical confirmation in the form of a break below $72 for Brent and $67 for WTI.

The FxPro Analyst Team