The price of a barrel of WTI crude oil fell by 0.7% and was in danger of falling below $70. OPEC+ helped overcome this level at the end of last week. As predicted by observers, the cartel postponed the ‘voluntary’ increase in production by key members for another quarter.

OPEC+’s actions look like an attempt to prevent the price from spiralling downwards. Mere signals of a breakdown in cartel unity may be enough for prices to collapse. This creates a trap for large producers that are bound by production commitments, as they lose their market share, most worryingly to the US.

US production reached a new record of 13.63 million bpd last week. Notably, production efficiency has increased, with the number of operating oil rigs at 482, well below the peaks of previous cycles but with higher output.

Taking back market share from the US is politically more difficult than from other parts of the Americas or Southeast Asia. This could mean that OPEC+ has opted for a managed decline strategy. We will not get a direct answer to this question, but we will keep an eye on the price as a key indicator.

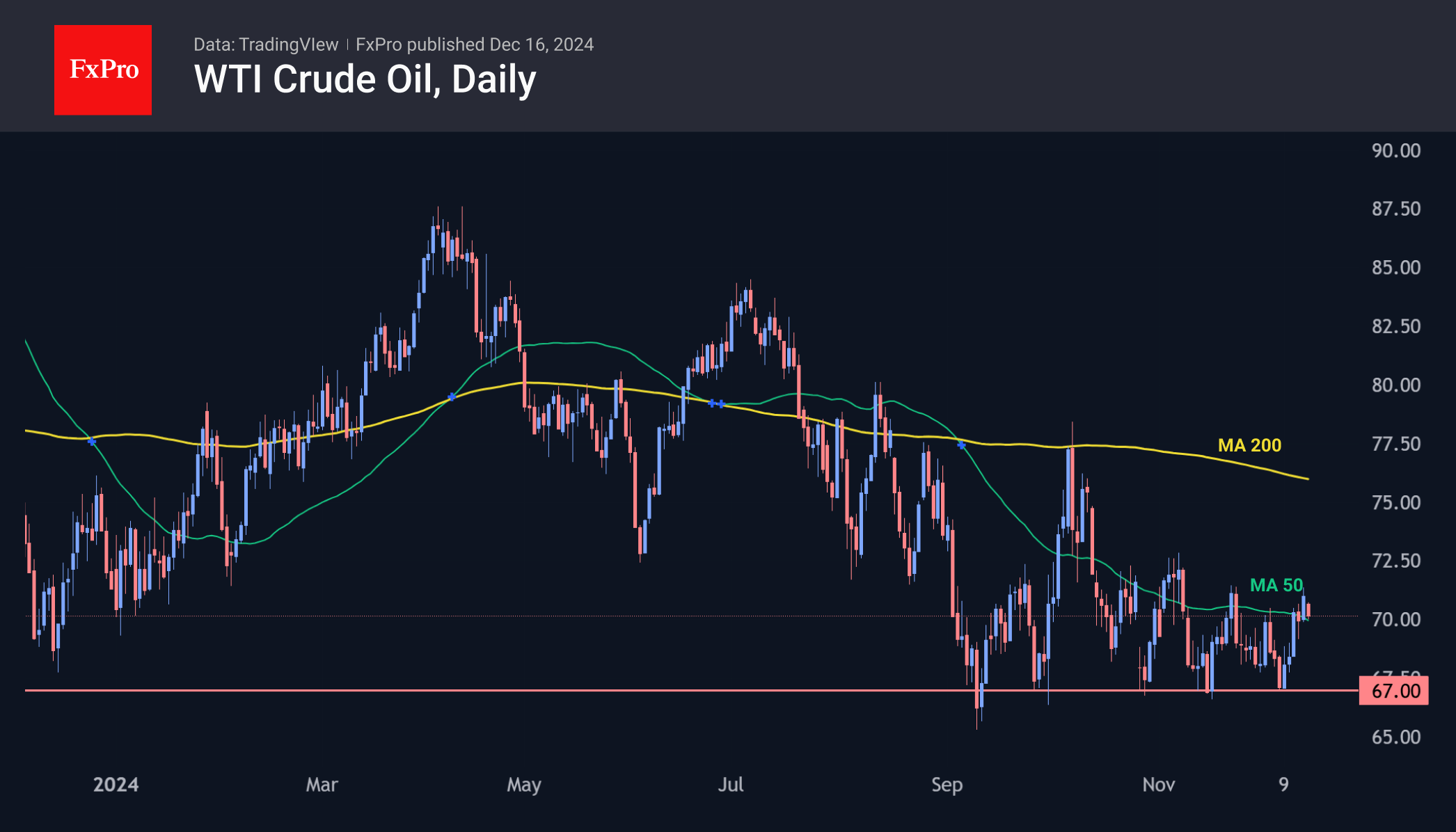

Over the past three months, WTI has made several attempts to break above its 50-day moving average just above $70. However, since the second half of 2021 of the year, oil has found support on dips below $67. In the second half of the year, the price has traded below the 50- and 200-week moving averages, indicating a bearish trend that has yet to be broken.

The last two trading weeks of the year could reinforce the downtrend as traders tend to lock in losses to optimise tax. This could reinforce the importance of the support level, as a breakdown could lead to a broader capitulation in a low liquidity environment. However, a retreat to the cycle low could also attract buyers, laying the groundwork for an uptrend next year.

The FxPro Analyst Team