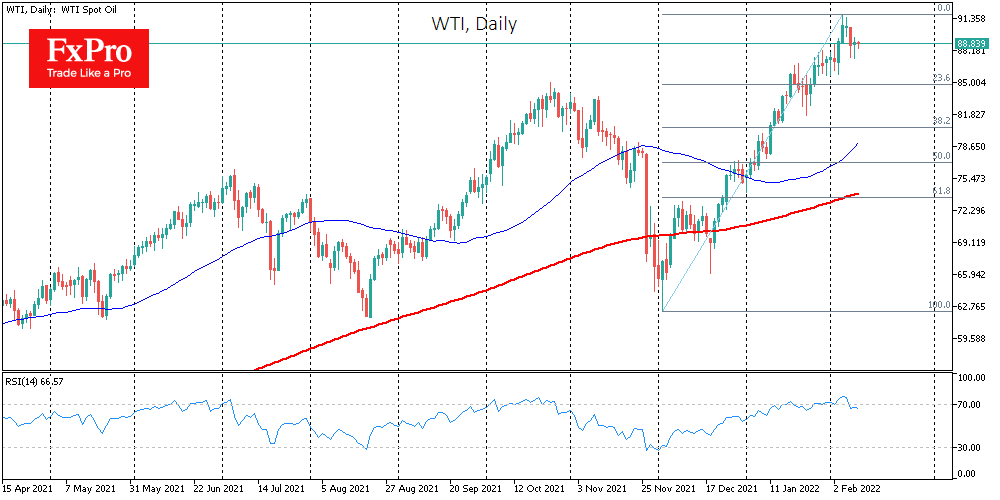

WTI crude oil has lost around 3% since the start of the week, bouncing back to $88.4 from $91.2 at the beginning of the week. The observed pullback looks like a technical correction to remove local overheating.

This correction comes against a relatively bullish background. Yesterday’s data marked a new drop in inventories, both commercial and strategic reserves. The Biden administration has said it may accelerate sales from reserves. Perhaps these comments were a formal excuse for profit-taking in the market. However, the start of these sales came with a two-month rally.

The government’s intention to sell off reserves may even have contributed to the rise in prices. The desire to bring prices down is hurting US production ramp-up plans. Aggressive support for alternative energy has made the hydrocarbon industry unattractive to banks.

As a result, we are seeing a much slower production recovery than in the recovery periods of the last decade. The number of rigs in operation is rising methodically, but it seems that new wells are only marginally offsetting spent ones.

Also, OPEC has repeatedly suggested that the industry’s severe underinvestment during the pandemic makes it impossible to ramp up production quickly now. Despite a favourable price environment, the cartel has not picked up quotas in recent months.

It is also worth mentioning that countries are not imposing new travel restrictions but are loosening them more and more, supporting energy demand. Also, commodity prices are supported by political pressure on Russia, which threatens gas supplies to Europe and further fuels price increases.

Locally, oil remains vulnerable to a corrective pullback after a more than two-month rally with potential targets at $84.5 for WTI – a 23.6% pullback from the rally and the October peak area. A deeper retracement scenario suggests a pullback to $80.3. For Brent, the near-term target is $86-87, with a deeper retracement to $83.

The FxPro Analyst Team