While U.S. crude stockpiles fell last week, the outlook for consumption is gloomy. October oil was steady near $43 a barrel and up 1.5% for the week. Futures surged to a five-month high on Monday on fresh China stimulus and as a gauge of builder sentiment in America jumped to its highest since 1998. However, optimism was tempered by downbeat comments from the U.S. Federal Reserve and OPEC+ on the demand outlook due to the coronavirus, while American unemployment benefits unexpectedly increased last week.

“The U.S. jobless data shows the threat pandemic is posing to the global economy and overall consumption,” Will Sungchil Yun, a senior commodities analyst at VI Investment Corp., said by phone from Seoul. “Even when there’s a vaccine available, OPEC+ may be required to step up to deal with the supply glut due to the weakened demand.”

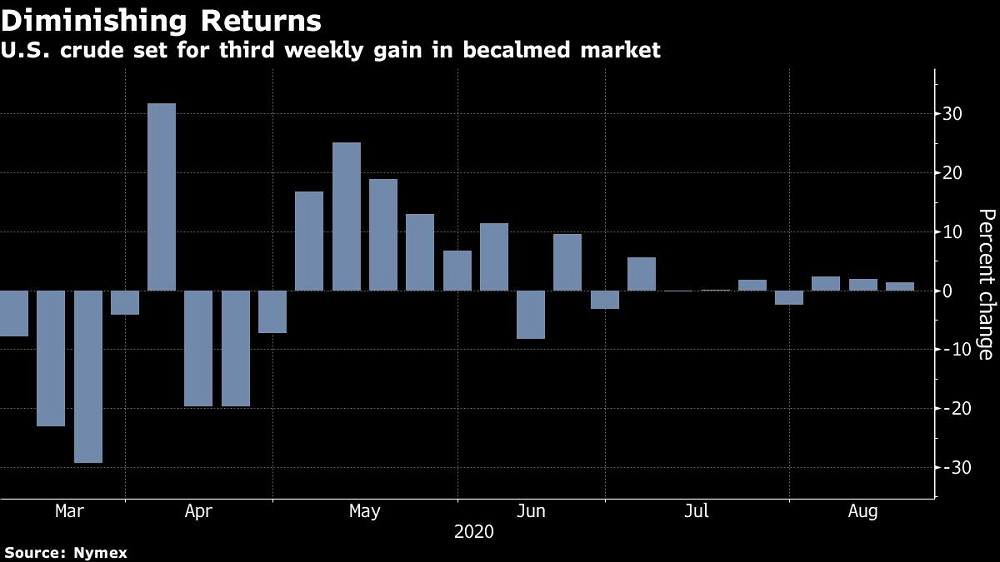

Oil Set for Third Weekly Gain With Bearish Headwinds Mounting, Bloomberg, Aug 21